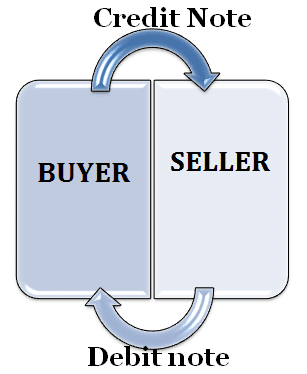

What is a completed credit note and debit note?

Introduction In the world of business transactions, financial documents like credit notes and debit notes play a crucial role in maintaining transparency and accuracy in accounting. These documents help businesses correct errors, issue refunds, or adjust invoices, ensuring smooth financial operations. Understanding their significance, usage,… Read More »