Tax planning with reference to amalgamation of companies?

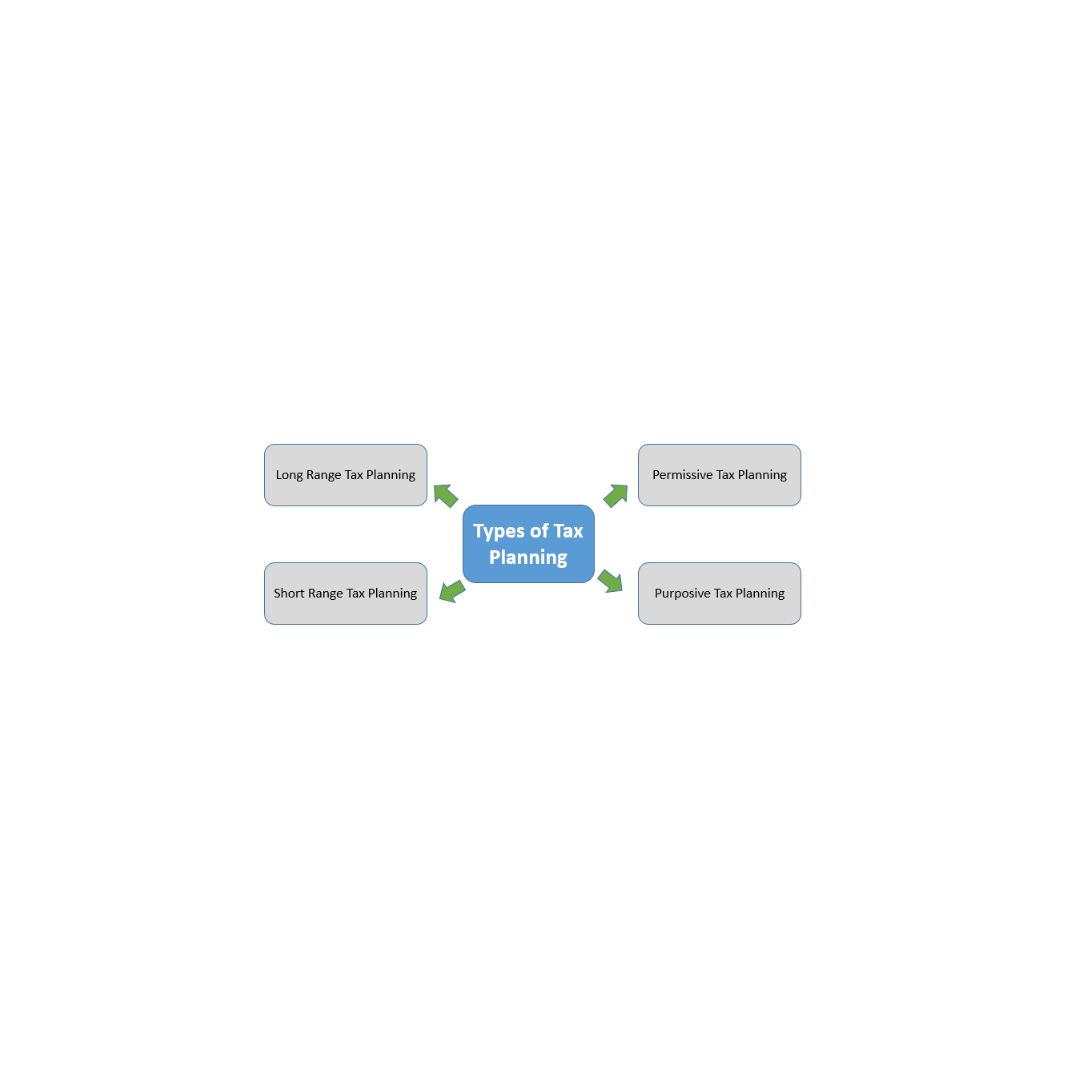

Amalgamation of companies Amalgamation of companies “Tax Planning in Company Amalgamations”: Tax planning, within the context of amalgamation of companies, refers to the strategic approach of structuring the transaction in a way that minimizes the tax implications for the participating companies and shareholders. Here’s a unique perspective on tax planning with reference to company amalgamations:… Read More »