Tax planning with reference to capital structure decision?

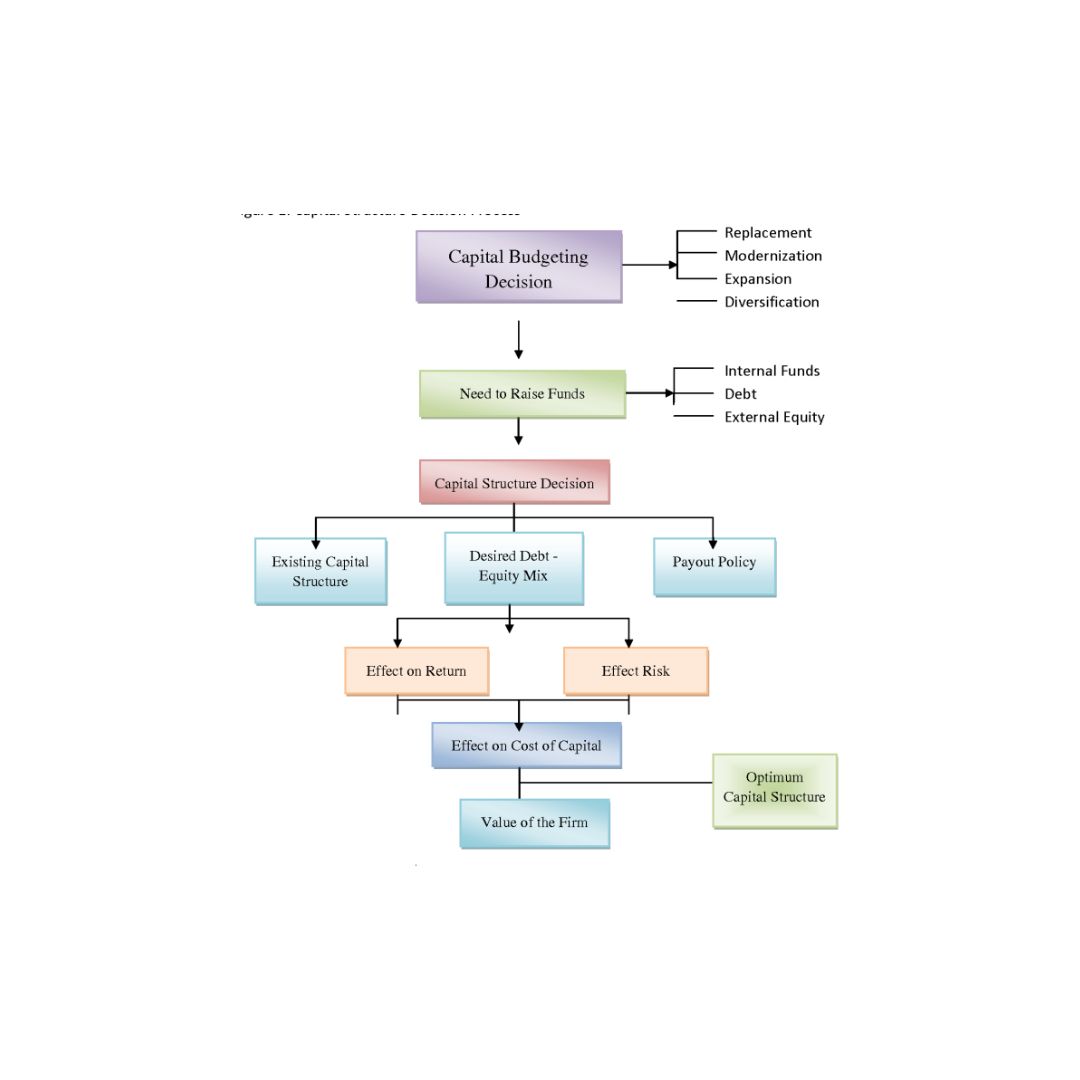

Tax efficiency Tax efficiency Taxation Optimization in Capital Structure Decisions”: Tax planning, with reference to capital structure decisions, involves considering the tax implications of different financing options and structuring the capital of a company in a tax-efficient manner. Here’s a fresh perspective on tax planning with respect to capital structure decisions: Tax planning in capital… Read More »