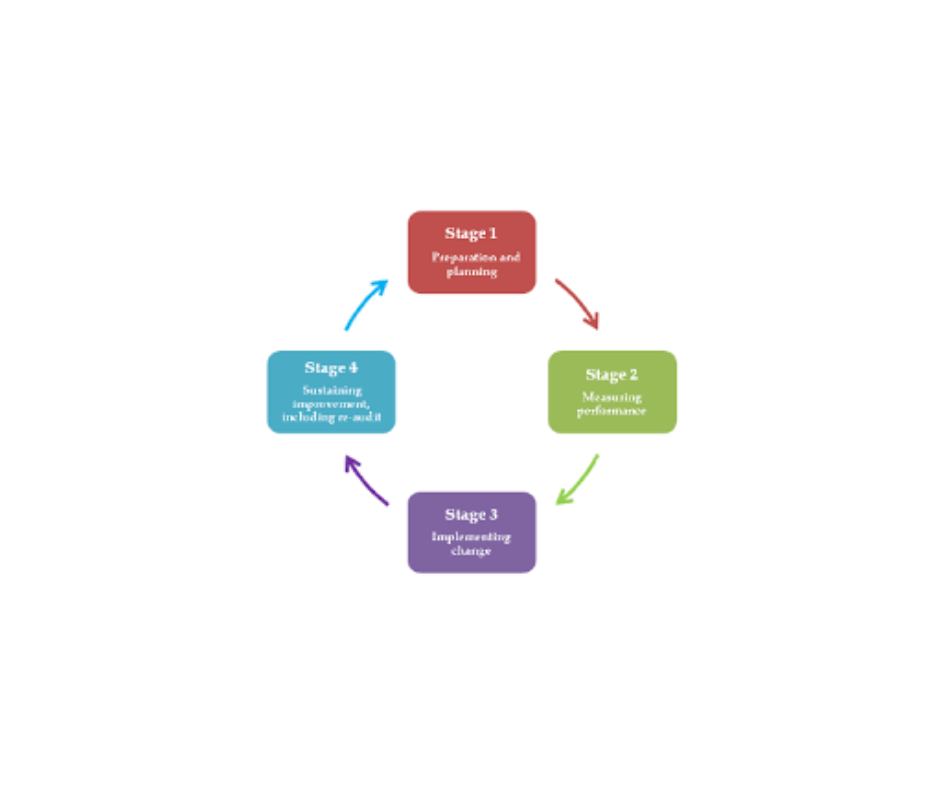

What are the stages of an audit?

Audit Stages Stages: An audit typically involves several stages, which can vary depending on the size and complexity of the organization being audited. However, the following are the general of an audit: 1.Planning: In this the auditor plans the audit by gaining an understanding of the organization and its business processes, identifying key areas of… Read More »