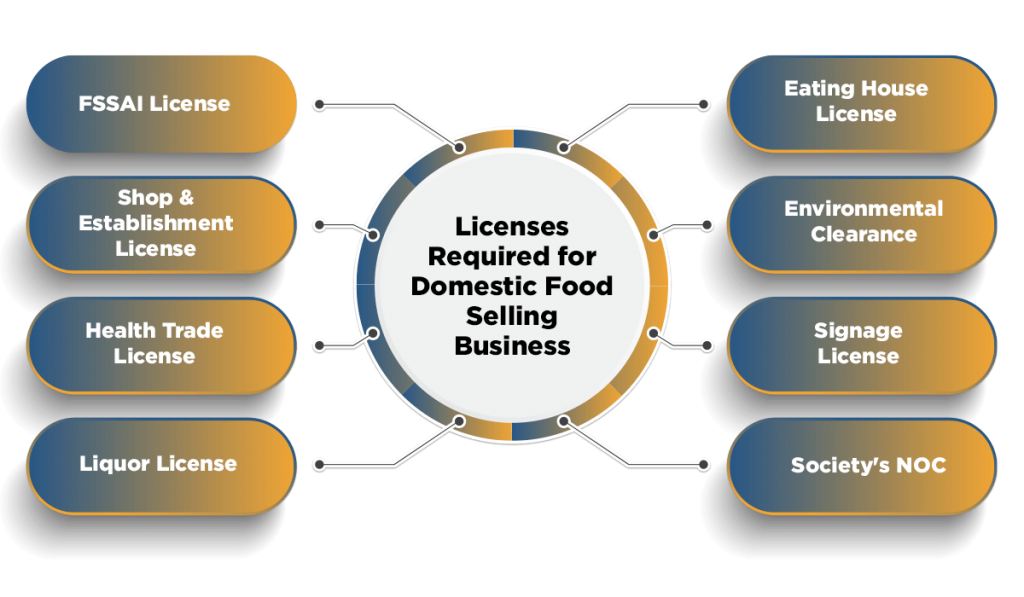

Business license for manufacturing?

Manufacturing Business license Introduction A business license is a crucial legal requirement for any enterprise, including manufacturing businesses. It serves as an official authorization to conduct business within a specific jurisdiction and ensures compliance with local, state, and federal regulations. For manufacturing companies, obtaining a business license is essential for maintaining operations without… Read More »