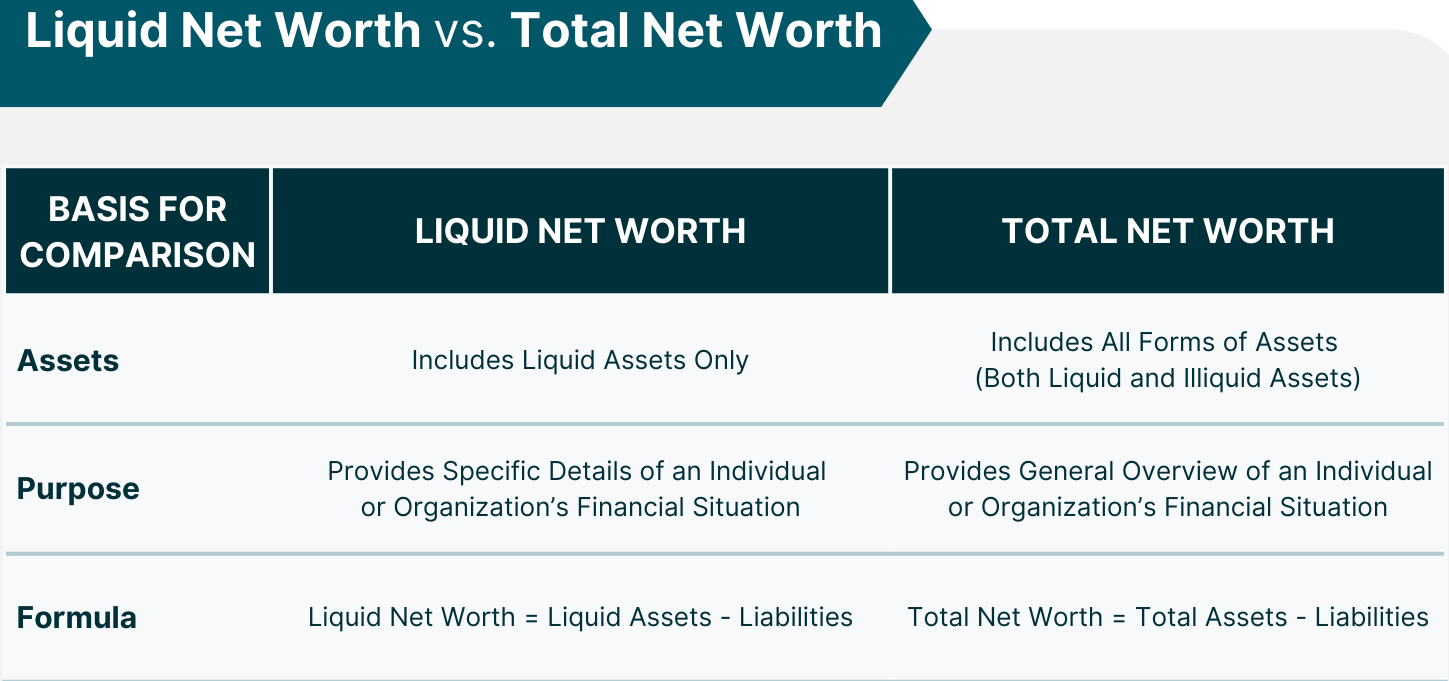

NetWorth V/s Liquid Capital?

NetWorth V/s LiquidCapital NetWorth v/s LiquidCapital are both financial terms used to assess an individual’s or organization’s financial position, but they represent different aspects of financial resources. Here’s a comparison between the two: Net Worth: Net worth refers to the total value of an individual’s or organization’s assets minus its liabilities. It provides a snapshot… Read More »