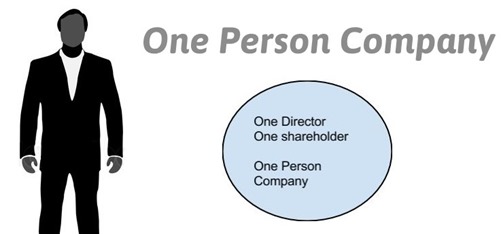

OPC is a statutory company?

Statutory company Statutory company: OPC (One Person Company) is not a statutory company. OPC refers to a type of business structure or legal entity recognized in certain jurisdictions, including India. It is a form of company where a single individual can establish a separate legal entity and enjoy limited liability protection similar to a… Read More »