What is the process of private limited company registration?

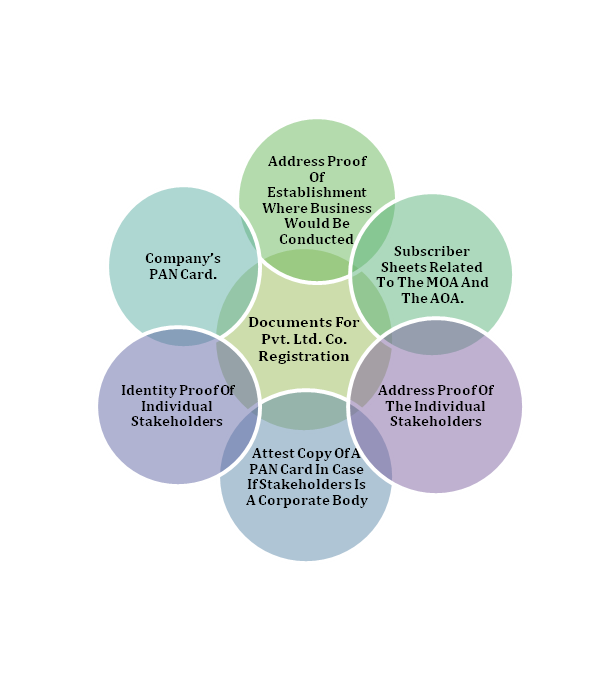

Private limited company Registration Private Limited Company registration, refers to the process of legally incorporating a business entity as a private limited company. A private limited company is a type of business structure in which the liability of its shareholders is limited to the amount unpaid on their shares. The registration process involves several… Read More »