LLP partners liable for debts right or wrong?

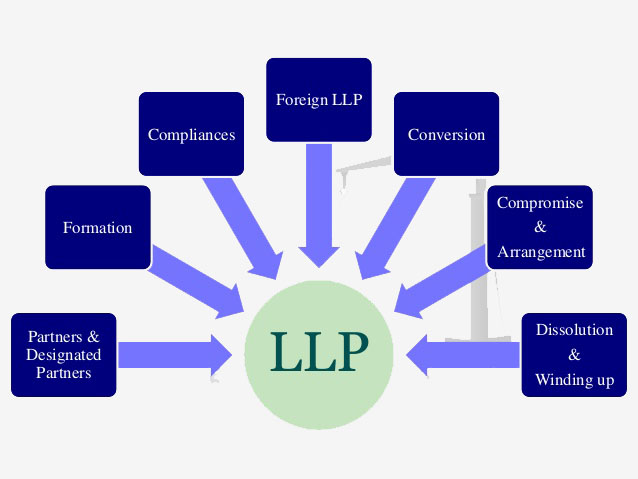

User Intent Users searching for information about LLP (Limited Liability Partnership) partners’ liability for debts want clarity on whether partners are responsible for the firm’s financial obligations. This article provides a comprehensive breakdown of their legal responsibilities, benefits, limitations, and comparisons to other business structures. Introduction When forming a business, choosing the right… Read More »