How can an LLP convert into OPC?

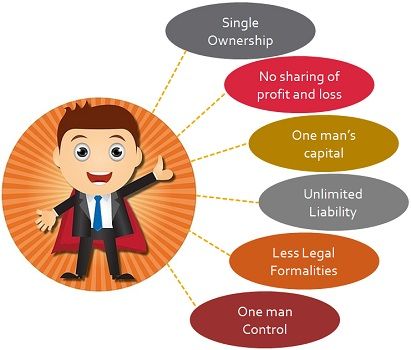

How can an LLP convert into OPC As businesses evolve, their structures often need to adapt to changing goals, ownership, and regulatory environments. One common transition is converting a Limited Liability Partnership (LLP) into a One Person Company (OPC). This article will guide you through the process, highlighting the benefits, eligibility criteria, and steps… Read More »