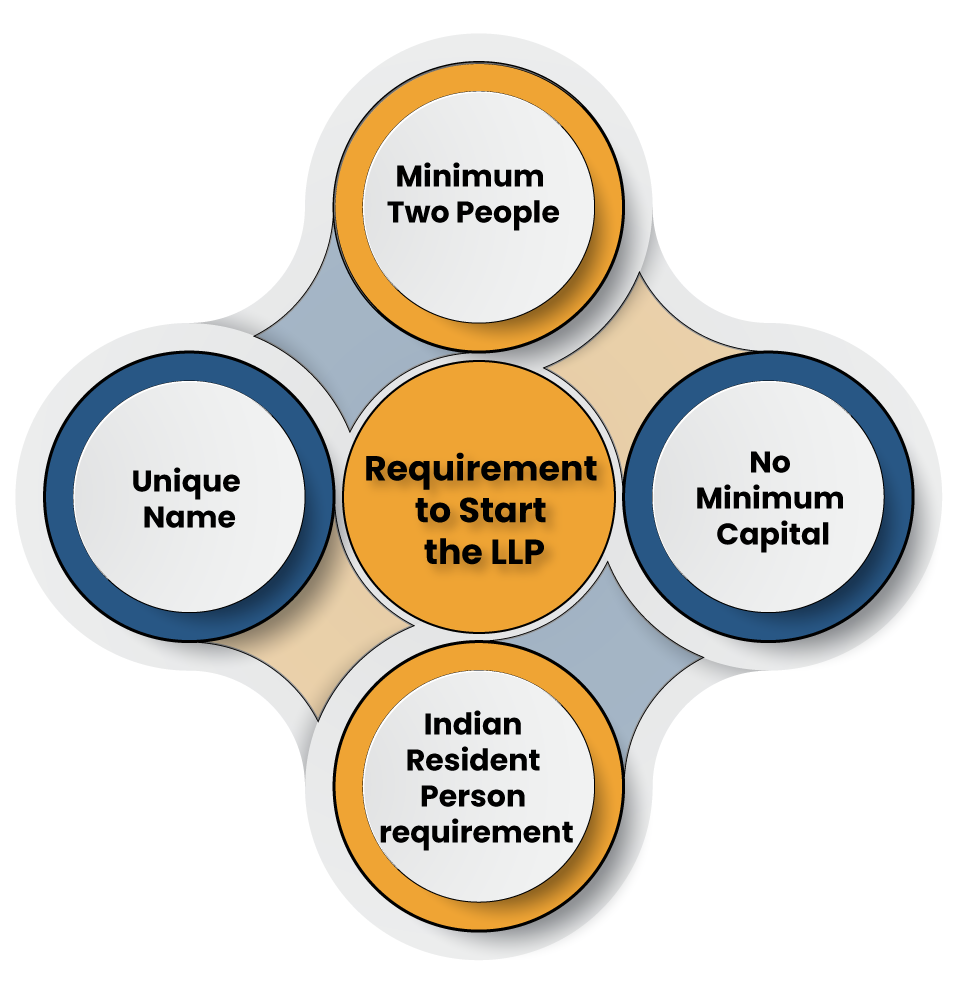

LLP with One Partner

LLP with One Partner In many jurisdictions, including India, it is possible to form an Limited Liability Partnership (LLP ) with one partner. This allows for the establishment of a single-member LLP. However, it’s important to note that the requirements and regulations for single-member LLPs may vary from country to country. Here are some… Read More »