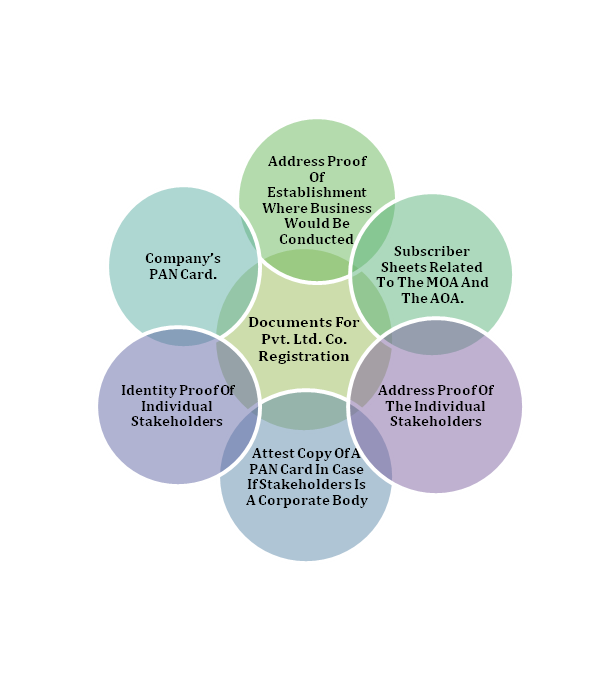

What are the documents required for private limited company registration?

Required Document for Pvt. Ltd Company The documents required for private limited company registration in India typically include the following: Identity and Address Proof Requirements for Directors and Shareholders: To fulfill the registration process, it is necessary to provide valid identity and address proof for both directors and shareholders involved in the company. These proofs… Read More »