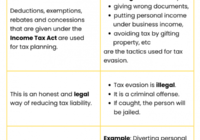

What is tax planning?

Understanding tax planning is crucial for individuals and businesses to minimize tax liability legally and maximize financial efficiency. This guide provides a comprehensive breakdown of tax planning, covering its definition, applications, benefits, limitations, and comparisons. Introduction Taxes are an inevitable part of financial life, whether you’re an individual earning a salary or a business… Read More »