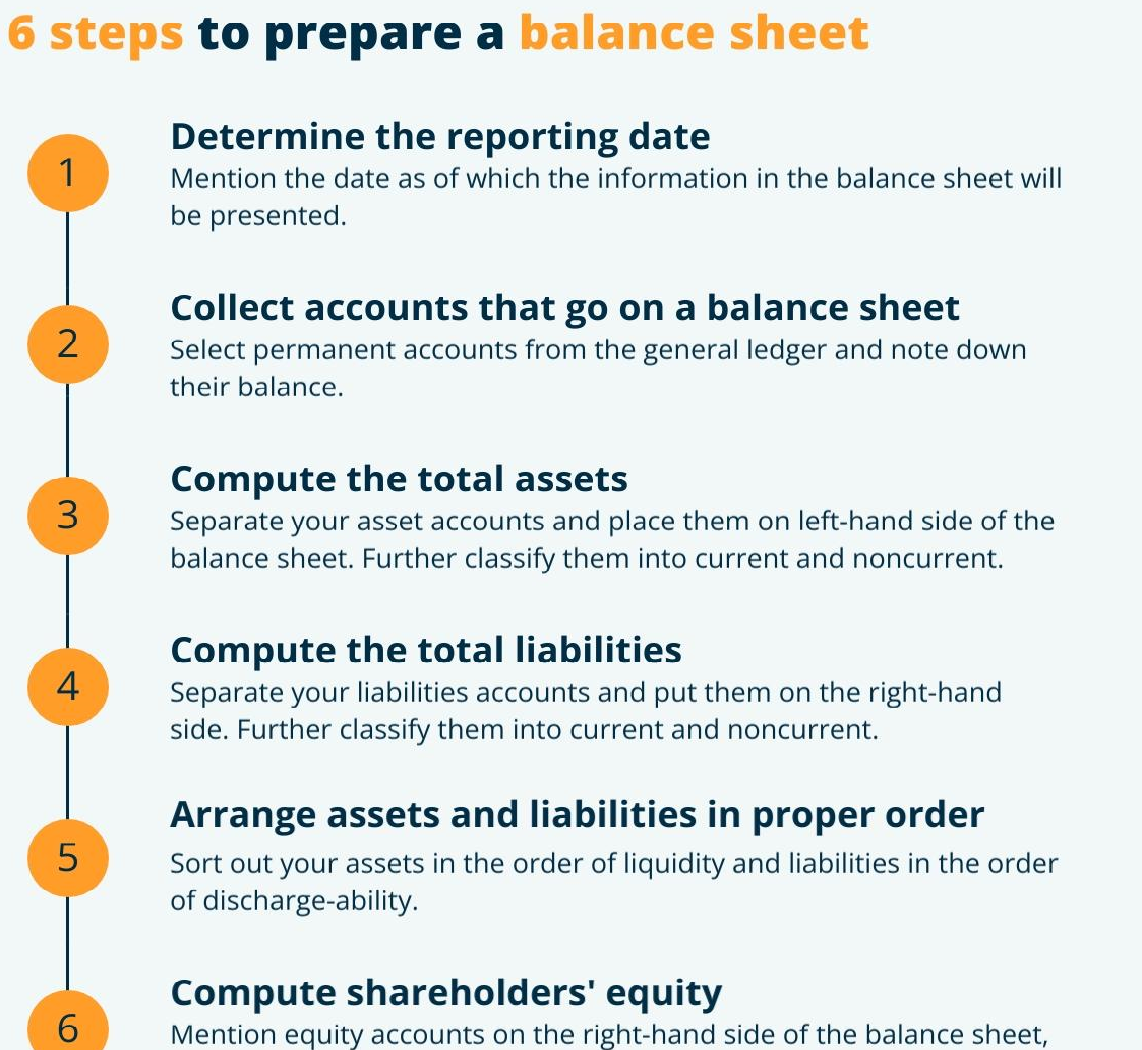

How to draft a balance sheet for the YouTubers ?

Drafting a balance sheet for YouTubers Here’s how to draft one: 1. Assets: Begin with listing the assets of the YouTuber. These include tangible assets like camera equipment, computers, and any property owned for content creation. Intangible assets like copyrights and trademarks can also be included. To visit: https://www.mca.gov.in/ 2. Liabilities: Outline the liabilities,… Read More »