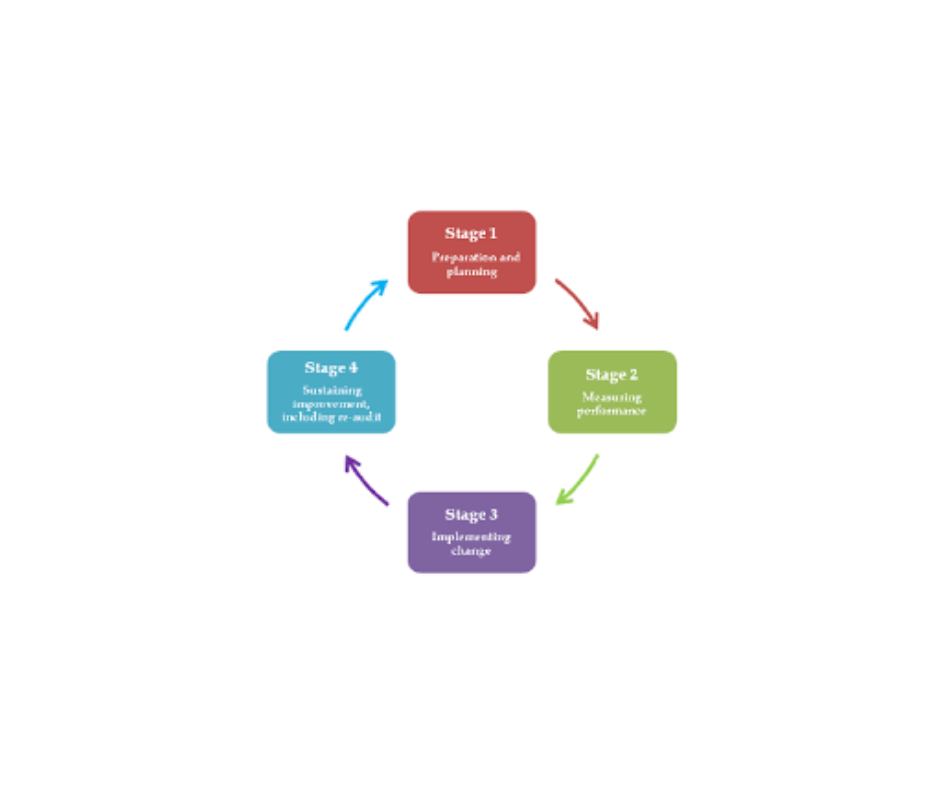

What is Audit Planning?

Audit Planning Audit planning: It is the process of designing and developing a strategy or roadmap for conducting an audit. It involves defining the scope and objectives of the audit, identifying potential areas of risk or concern, determining the resources need to carry out the audit, and creating a timeline for completing the audit.… Read More »