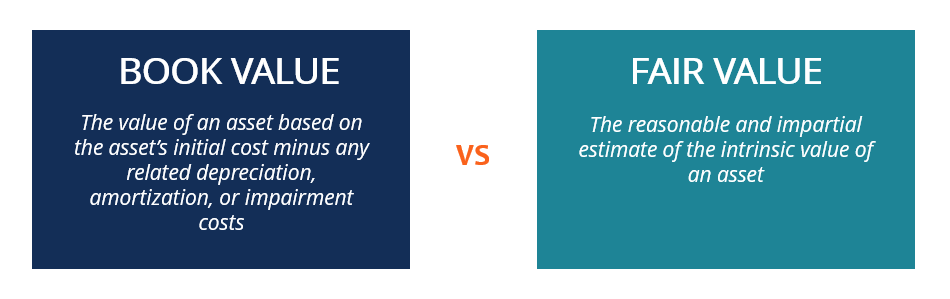

Are assets recorded at fair value

Fair Value Accounting Assets can record at fair value under certain circumstances and accounting standards. Fair value accounting is an approach where assets measured and reported on the financial statements at their current market value. The fair value denotes the price at which an asset could trad between informed and willing parties in a… Read More »