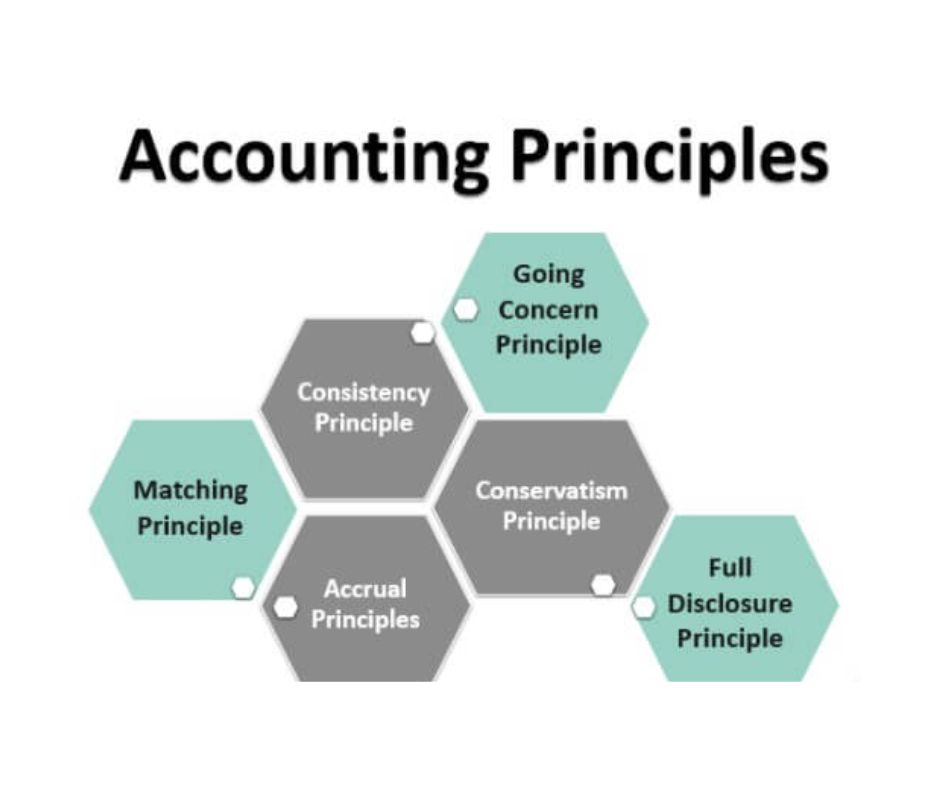

What are Bookkeeping Accounting Principles?

Bookkeeping Accounting Principles Bookkeeping Accounting Principles are closely intertwine terms that encompass the meticulous documentation, arrangement, and communication of financial transactions and data for a business or organization. Despite their interconnections, these two concepts hold separate significance. Going Concern Principle: This principle assumes that a business will continue its operations in the foreseeable future.… Read More »