What is Audit Process ?

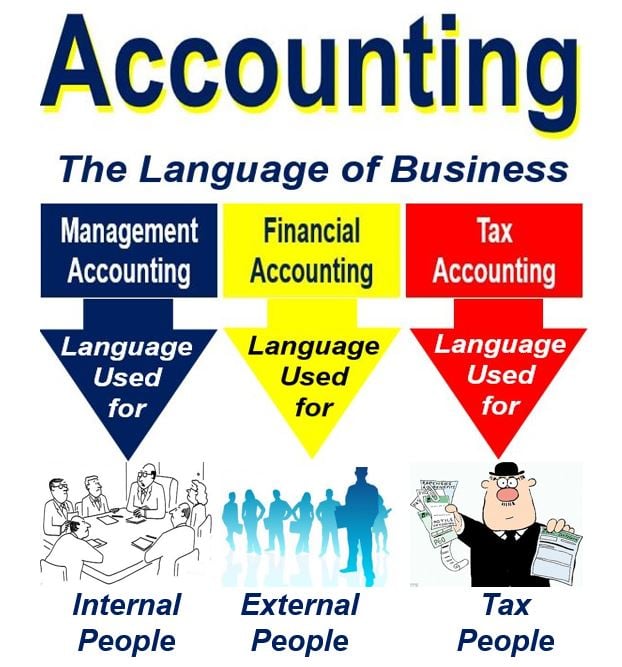

Introduction In the modern business landscape, financial transparency and compliance with regulations are crucial for maintaining trust among stakeholders. The audit process plays a significant role in ensuring accuracy, efficiency, and legal compliance in financial reporting. Whether it’s a small business, a large corporation, or a government entity, audits help in assessing financial health, preventing… Read More »