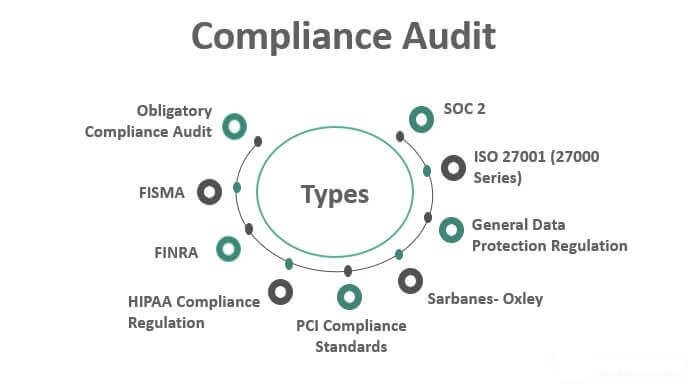

What is internal audit assurance?

Internal audit assurance Internal audit assurance, involves conducting an impartial and unbiased evaluation of an organization’s internal controls, risk management procedures, and governance structures with the goal of providing a distinctive assessment. It is conducted by an internal audit function or department within the organization. The primary purpose of internal audit assurance is to provide independent… Read More »