What qualifies as liquid net worth?

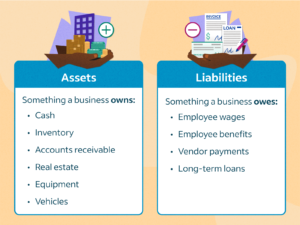

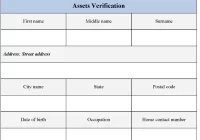

Qualifies as Liquid Net Worth Qualifies as Liquid Net Worth, Liquid net worth is the term used to describe the part of someone’s or an organization’s total net worth that comprises assets which can be easily convert into cash without experiencing substantial depreciation in value or time delay. The specific assets that qualify as… Read More »