Startup Registration

The business environment in India is dynamic, offering both opportunities and challenges for entrepreneurs and businesses.

Opportunities:

India boasts a large and growing consumer market, a diverse talent pool, and a rapidly expanding digital infrastructure.

Key sectors such as technology, e-commerce, healthcare, education, and renewable energy present significant growth opportunities.

Government initiatives such as Make in India, Digital India, and Startup India aim to foster entrepreneurship and economic growth.

Challenges:

Despite its potential, India’s business environment is characterized by regulatory complexity, bureaucratic hurdles, infrastructure bottlenecks, and occasional political instability. Taxation issues, corruption, and legal disputes can pose challenges for businesses.

Additionally, cultural diversity and regional disparities require businesses to adapt their strategies to varying market conditions across different states.

Despite above mentioned challenges, India’s startup ecosystem has witnessed the emergence of several unicorns (startups valued at over $1 billion) across various sectors. While some unicorns have achieved significant success, others are poised for growth in the future.

Startup Registration:

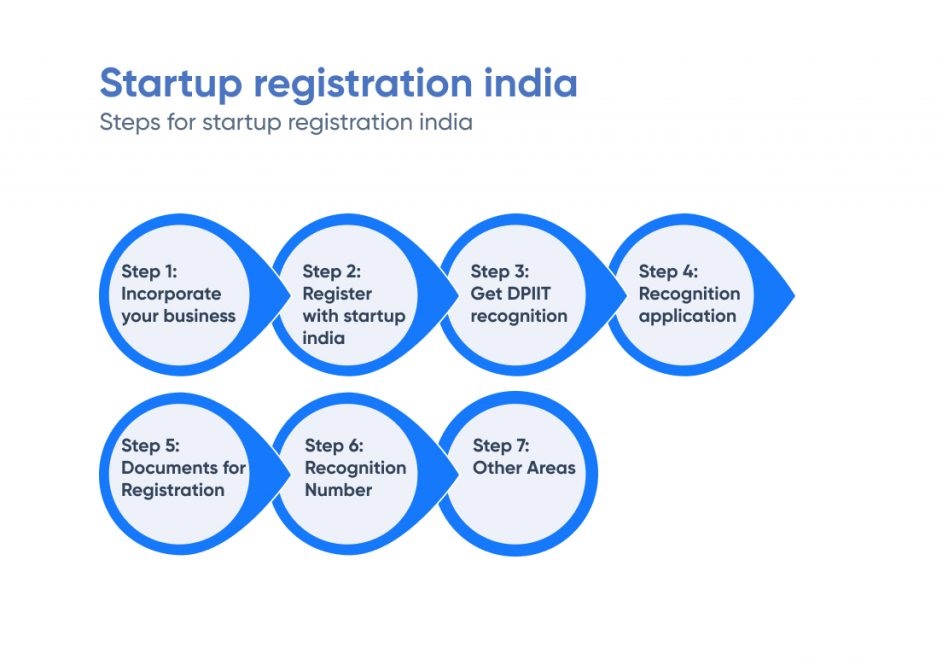

Registering a startup in India involves several steps and considerations, broadly elaborated below:

(i) Choose a Business Structure:

Decide on the type of business entity you want to establish. Common options for startups include: Sole Proprietorship Partnership Firm Limited Liability Partnership (LLP) Private Limited Company One Person Company (OPC)

(ii) Select a Business Name:

Choose a unique name for your startup. Ensure that the name is not already registered by another entity and complies with the naming guidelines provided by the Ministry of Corporate Affairs (MCA).

(iii) Obtain Digital Signature Certificate (DSC):

The first step towards online registration is to obtain a Digital Signature Certificate for the proposed directors/partners. DSC is required for digitally signing the incorporation documents.

(iv) Apply for Director Identification Number (DIN):

If you’re registering a company, the proposed directors need to obtain DIN from the Ministry of Corporate Affairs. It’s a unique identification number required for directors.

(v) Incorporation/Registration:

Depending on the chosen business structure, follow the relevant incorporation/ registration procedure:

(a) For Private Limited Company/OPC: File SPICe+ (INC-32) form along with Memorandum of Association (MoA) and Articles of Association (AoA).

(b) For LLP: File Form FiLLiP (Form for Incorporation of Limited Liability Partnership).

(c) For Partnership Firm: Draft a Partnership Deed and register it.

(d) For Sole Proprietorship: No separate registration is required. You can operate your business under your name or a trade name with your personal PAN.

(e) Apply for PAN and TAN: After incorporation, apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your business. These are required for tax purposes.

(f) Goods and Services Tax (GST) Registration: If your business turnover exceeds the threshold limit (currently ₹20 lakh for most states), you need to register for GST. GST registration is mandatory for businesses engaged in providing taxable goods or services.

(g) Register with Startup India: Consider registering your startup with Startup India, an initiative by the Government of India to promote startups.

Registration provides various benefits, including tax exemptions, funding support, and access to networking opportunities.

(vi) Compliance Requirements:

Ensure compliance with ongoing regulatory requirements, including filing annual returns, maintaining statutory records, and complying with tax regulations.

(vii) Other Registrations and Licenses:

Depending on the nature of your business, you may need to obtain additional registrations or licenses, such as:

(a) Shops and Establishment License

(b) Professional Tax Registration

(c) Import-Export Code (IEC) for international trade

(d) Intellectual Property Protection: Consider protecting your intellectual property through trademarks, copyrights, or patents, if applicable.

(viii) Open Bank Account:

Finally, open a business bank (current) account in the name of your company/partnership firm/LLP to carry out financial transactions.

As the overall incorporation process, as per the chosen form of business registration, is technical It’s advisable to seek professional assistance from chartered accountants, company secretaries, or legal advisors to ensure compliance with all legal and regulatory requirements during the startup registration process.

Additionally, keep yourself updated with any changes in laws or regulations related to business registration in India.

FAQ’s on Startup Registration:

1. How to apply for startup registration?

Ans: To apply for startup registration in India: Visit the Startup India website. Create an account and fill out the application form with your startup details.

Upload necessary documents like Certificate of Incorporation. Self-certify that your startup meets eligibility criteria. Submit the application online. Await acknowledgment and review.

Upon approval, avail benefits and support services. Ensure accuracy and compliance throughout the process.

2. How to get startup registration certificate?

Ans: To get a startup registration certificate in India: Ensure your business meets eligibility criteria. Register on the Startup India website. Fill out the application form with startup details.

Upload required documents like Certificate of Incorporation. Self-certify eligibility criteria. Submit the application. Await acknowledgment and review. Upon approval, receive startup registration certificate.

3. How to check startup registration status?

Ans: To check the startup registration status in India: Log in to the Startup India portal.

Navigate to the “Check Startup Recognition” section. Enter your registration details. Submit the information. View the status of your startup registration.

4. Startup registration in india?

Ans: To register a startup in India: Ensure eligibility criteria are met. Register on the Startup India portal. Fill application form with startup details. Upload required documents.

Self-certify eligibility criteria. Submit application. Await acknowledgment and review. Upon approval, receive startup registration certificate.

5. What are the startup registration process?

Ans: Startup registration process in India: Verify eligibility criteria. Register on Startup India portal. Fill application with startup details. Upload necessary documents. Self-certify eligibility. Submit application. Await acknowledgment and review. Upon approval, receive startup registration.

6. What are the startup registration benefits?

Ans: Startup registration benefits in India:

Tax benefits and exemptions, Access to government schemes and funding, Ease of compliance and regulatory support, Intellectual property rights facilitation, Networking opportunities and mentorship, Eligibility for subsidies and grants, Recognition and credibility in the ecosystem, Access to incubators and accelerators.

7. What are the startup registration documents required?

Ans: For Startup registration in India below set of documents are required:

i. Identity proof (PAN, Aadhaar, Passport, or Driver’s License)

ii. Address proof (Aadhaar, Passport, Voter ID, or Driver’s License)

iii. Proof of business address (Utility bills, rental agreement, or property tax receipt)

iv. Memorandum of Association (MoA) and Articles of Association (AoA) for companies

v. Certificate of Incorporation for companies

vi. Partnership Deed for LLPs and partnership firms

vii. Director Identification Number (DIN) for directors of companies

viii. Digital Signature Certificate (DSC) for online filing.

Additional documents as per specific requirements (NOC, consent letters, affidavits, etc.).

Verify that all documents are precise and correct prior to submission.

For further details access our website: https://vibrantfinserv.com