Sole proprietorship vs OPC

Here are the notable distinctions between an OPC (One Person Company) and a sole proprietorship:

Legal Structure:

OPC: An OPC is a legally recognized entity that is registered under the Companies Act. An OPC (One Person Company) is recognized as an independent legal entity distinct from its owner.

Sole Proprietorship: A sole proprietorship does not have a separate legal identity. In a sole proprietorship, there is no legal distinction between the business and the owner—they consider as a single entity.

Ownership:

OPC: An OPC owns by a single individual who acts as both the director and shareholder of the company.

Sole Proprietorship: In a sole proprietorship, the business owns and manages by a single individual.

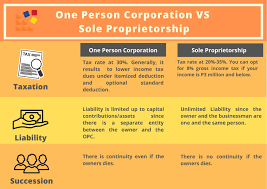

Liability:

OPC: The liability of the owner in an OPC is limited to the extent of the capital invested in the company. The personal assets of the owner generally safeguards from the company’s liabilities.

Sole Proprietorship: In a sole proprietorship, the owner assumes unlimited personal liability. This means that the owner is personally liable for all the debts and obligations of the business and their personal assets may be at risk.

Compliance Requirements:

OPC: An OPC has more stringent compliance requirements compared to a sole proprietorship. It must maintain proper accounting records, conduct annual audits, and file annual returns with the Registrar of Companies (RoC).

Sole Proprietorship: The compliance requirements for a sole proprietorship are relatively simpler. Because, The owner is responsible for maintaining business records and fulfilling tax obligations.

Continuity:

OPC: An OPC has better continuity as it can continue to exist even if the owner resigns, dies, or becomes incapacitated. It can transfer to another person as per the provisions of the Companies Act.

Sole Proprietorship: The continuity of a sole proprietorship is closely tied to the owner. If the owner decides to discontinue the business or passes away, the sole proprietorship typically ceases to exist.

Understanding these differences can help individuals choose the appropriate business structure based on their specific requirements and objectives. Consulting with a legal professional or business advisor recommend to ensure compliance with relevant laws and regulations.

For more information visit this site: https://www.mca.gov.in

FAQs

1. What is an OPC?

- A One Person Company (OPC) is a type of private company with only one shareholder. It allows for limited liability, meaning personal assets are protect from business debts.

2. How are they formed?

- Sole Proprietorship: Requires minimal registration, usually just a business license or permit.

- OPC: Must be register with the Registrar of Companies (ROC) and requires a Memorandum and Articles of Association.

3. What are the liability implications?

- Sole Proprietorship: The owner has unlimited liability, meaning personal assets can be use to pay business debts.

- OPC: The owner has limited liability; personal assets are protected from business creditors.

4. How is taxation handle?

-

- OPC: Taxed as a corporate entity, which may have different tax rates and benefits.

5. What happens to the business if the owner dies?

- Sole Proprietorship: The business ceases to exist unless there are arrangements for transfer.

- OPC: The business can continue to operate, as it is a separate legal entity.

6. Can an OPC have more than one owner?

- Sole Proprietorship: Only one owner is allow.

- OPC: Cannot have more than one shareholder; however, it can be convert to a private limited company if needed.

7. What are the compliance requirements?

- Sole Proprietorship: Minimal compliance; mostly depends on local laws.

- OPC: Higher compliance, including annual returns, financial statements, and board meetings.

8. Is it easier to raise funds in one over the other?

- Sole Proprietorship: Generally harder to raise funds, as lenders often prefer businesses with limited liability.

- OPC: Easier to raise funds, as it is recognize as a company, which can attract investors and loans.

9. Which is better for a small business?

- Sole Proprietorship: Suitable for small businesses with low risk and fewer liabilities.

- OPC: Better for entrepreneurs who want limited liability and plan for growth.

For further details access our website https://vibrantfinserv.com