-

Salaries

-

Website Link

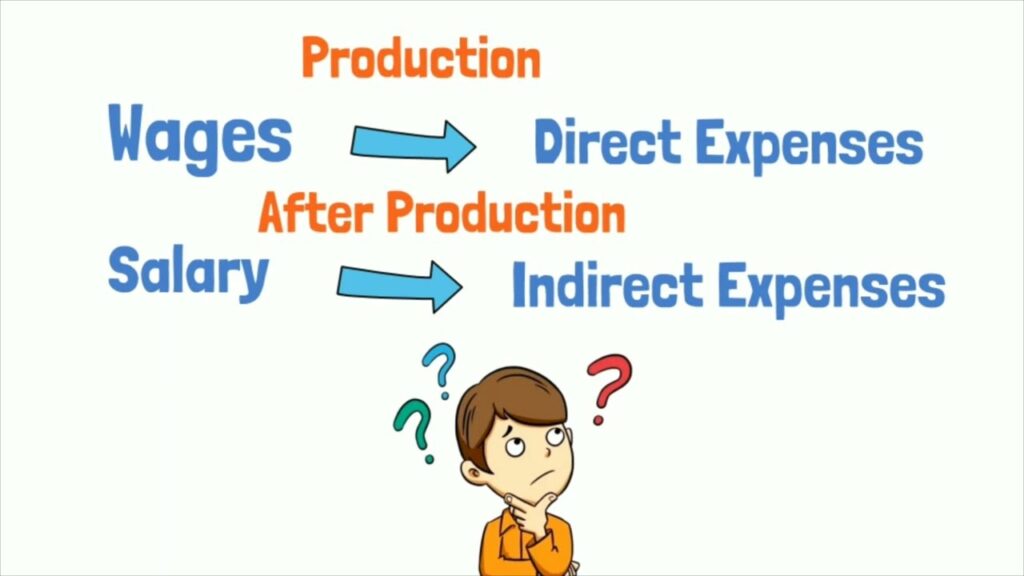

Salaries and wages are both expenses related to employee compensation, but they are classified differently based on their association with the production process.

Wages are considered a direct expense because they are directly related to the production of goods or services. Wages are typically paid to workers who are directly involved in the production process, such as factory workers or sales personnel. Since wages are incurred as a result of the actual production of goods or services, they are considered a direct expense.

On the other hand, salaries are considered an indirect expense because they are not directly associated with the production process. Salary is typically paid to employees who are not directly involved in the production process, such as managers or administrative staff. While these employees are essential for the functioning of the business, their Salary are not directly related to the production of goods or services. Therefore, salaries are classified as an indirect expense.

It’s important to note that these classifications may vary based on the specific nature of a business and its operations.

For further details Visit: https://vibrantfinserv.com/service-detail-25.php

To visit: https://www.incometax.gov.in

Contact: 8130555124, 8130045124

Whatsapp: https://wa.me/918130555124

Mail ID: operations@vibrantfinserv.com

Web Link: https://vibrantfinserv.com

FB Link: https://fb.me/vibrantfinserv

Insta Link: https://www.instagram.com/vibrantfinserv2/

Twitter: https://twitter.com/VibrantFinserv

Linkedin: https://www.linkedin.com/in/vibrant-finserv-62566a259/