User Intent

Users searching for “Minimum requirements for LLP” are typically looking for a detailed guide on eligibility, registration process, legal formalities, and compliance needed to establish a Limited Liability Partnership (LLP). They might be entrepreneurs, business owners, or legal consultants who need precise, SEO-friendly information with clear explanations, benefits, and limitations.

Introduction

A Limited Liability Partnership (LLP) is a hybrid business structure that combines features of a partnership and a company. It provides limited liability to its partners while maintaining operational flexibility. Unlike a traditional partnership, LLPs protect personal assets and require fewer compliances than companies. Before registering an LLP, it is crucial to understand the minimum requirements and legal obligations involved.

Definition

of LLP A Limited Liability Partnership (LLP) is a separate legal entity that allows two or more individuals to operate a business with limited liability protection. It was introduced to encourage entrepreneurship while providing a less complex regulatory framework compared to private limited companies. LLPs operate under the Limited Liability Partnership Act, 2008 in India.

To visit: https://www.mca.gov.in/

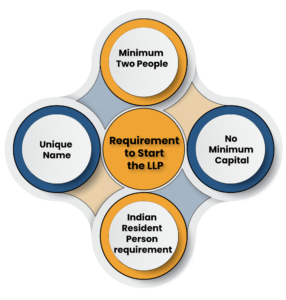

Minimum Requirements for LLP Registration

To register an LLP, businesses must fulfill certain basic requirements. Here’s a step-by-step breakdown:

1. Minimum Number of Partners

- An LLP must have at least two partners at the time of incorporation.

- There is no upper limit on the number of partners.

2. Designated Partners & DIN

- At least two designated partners must be appointed.

- They must have a Director Identification Number (DIN) issued by the Ministry of Corporate Affairs (MCA).

3. Partner’s Eligibility

- Individuals, corporate bodies, or foreign nationals can be partners.

- At least one designated partner must be a resident of India.

4. Unique Name Approval

- The LLP’s name should be unique and not similar to existing businesses.

- It must follow the naming guidelines of the MCA.

5. Registered Office Address

- An LLP must have a registered office in India.

- It can be a commercial or residential address.

6. Digital Signature Certificate (DSC)

- Partners must obtain a DSC for online filings with the MCA.

7. LLP Agreement

- A legal agreement defining rights, duties, and responsibilities of partners is mandatory.

- It should be drafted on stamp paper and filed with the Registrar of Companies (ROC).

8. Initial Capital Contribution

- There is no minimum capital requirement, but partners must contribute some capital.

9. Required Documents

- PAN & Aadhaar of partners.

- Address proof of partners (utility bill/bank statement).

- Proof of registered office (rental agreement, NOC from owner).

- Passport (for foreign partners).

Benefits of LLP

An LLP provides several advantages that make it an ideal business structure. Here are the top benefits:

1. Limited Liability Protection

- Personal assets of partners are not affected by LLP debts.

- Liability is limited to the capital contribution.

2. Separate Legal Entity

- An LLP has a distinct legal identity from its partners.

- It can own assets, enter contracts, and sue or be sued in its name.

3. No Minimum Capital Requirement

- Unlike a private limited company, an LLP does not require a minimum capital.

4. Fewer Compliance Requirements

- LLPs have simpler regulations compared to companies.

- No mandatory audits unless annual turnover exceeds ₹40 lakhs or contribution exceeds ₹25 lakhs.

5. Tax Benefits

- LLPs are taxed at 30% flat rate but enjoy no dividend distribution tax (DDT).

- They benefit from pass-through taxation, avoiding double taxation.

6. Easy Transfer & Exit

- LLP ownership can be easily transferred through agreement.

- Winding up procedures are less complex than companies.

Limitations of LLP

Despite the advantages, LLPs also have some drawbacks:

1. Higher Penalty for Non-Compliance

- LLPs failing to file annual returns face a penalty of ₹100 per day, with no upper limit.

2. Limited Fundraising Options

- LLPs cannot issue shares or raise equity capital.

- Funding options are restricted to loans or partner contributions.

3. Difficulty in Expansion

- Since LLPs cannot raise public funds, scaling up can be challenging.

- Many investors prefer private limited companies over LLPs.

4. Restrictions on Business Activities

- LLPs cannot engage in banking, insurance, or investment businesses.

Comparative Table: LLP vs Private Limited Company

| Feature | LLP | Private Limited Company |

|---|---|---|

| Legal Status | Separate Legal Entity | Separate Legal Entity |

| Liability | Limited to capital contribution | Limited to capital investment |

| Compliance | Low compliance, minimal reporting | High compliance, detailed reporting |

| Fundraising | Limited (No equity funding) | Can raise funds through shares |

| Taxation | No Dividend Tax | Dividend Tax applicable |

| Ownership Transfer | Easier through agreement | More complex, shares involved |

| Annual Audit | Only if turnover > ₹40L or contribution > ₹25L | Mandatory regardless of turnover |

| Suitable For | Small businesses & professionals | Startups, growing businesses |

Conclusion An LLP is an excellent business structure for those seeking limited liability, flexibility, and fewer compliance requirements. However, it may not be suitable for businesses that require external funding or rapid expansion. Entrepreneurs should carefully evaluate their business needs, financial goals, and long-term plans before choosing between an LLP and other structures like Private Limited Companies.

FAQs

1. Can a single person start an LLP?

No, a minimum of two partners is required.

2. Is there a mandatory minimum capital for LLP?

No, LLPs do not require a minimum capital contribution.

3. How long does LLP registration take?

It usually takes 10-15 working days, depending on document verification and name approval.

4. Can an LLP be converted into a private limited company?

Yes, but it requires compliance with Companies Act, 2013, and ROC approval.

5. Does an LLP require an annual audit?

Only if turnover exceeds ₹40 lakhs or capital contribution is above ₹25 lakhs.

6. Can LLP partners take a salary?

Yes, but only designated partners can receive a remuneration as per the LLP agreement.

For further details access our website: https://vibrantfinserv.com