![]()

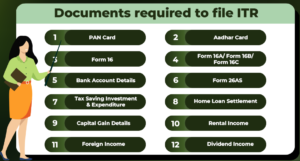

Require Documents for File ITR

Here are the Require Documents for File ITR:

1. Form 16:

This is provided by your employer and summarizes your salary, deductions, and taxes withheld. It’s crucial for reporting your salary income accurately.

2. Salary Slips:

These documents detail your monthly earnings, allowances, and deductions. They help cross-check the information in your Form 16.

3. Bank Statements:

Your bank statements provide evidence of your financial transactions, including interest earned, loans repaid, and other income sources.

4. Proof of Investments:

This includes documents related to tax-saving investments such as Public Provident Fund (PPF), National Savings Certificate (NSC), and Equity-Linked Savings Scheme (ELSS).

5. Property Documents:

If you own property, you’ll need details like property value, home loan statements, and rental income details.

6. Capital Gains Documents:

If you’ve sold any assets like stocks, bonds, or property, you’ll need the relevant sale and purchase documents.

7. Interest Certificates:

These show the interest earned on fixed deposits, savings accounts, or any other interest-bearing investments.

8. Form 26AS:

This document provides a consolidated view of taxes deducted on your behalf and any advance tax paid.

9. Home Loan Certificates:

If you have a home loan, you’ll need documents showing the interest and principal repaid during the year.

10. Medical Bills:

Receipts of medical expenses that can be claimed for deductions under applicable sections of the Income Tax Act.

11. HRA Proof:

If you’re claiming House Rent Allowance (HRA), you’ll need rent receipts and the landlord’s PAN if the rent exceeds a certain limit.

12. TDS Certificates:

These certificates are issued by banks or other entities deducting tax at source, and they confirm the tax deducted.

13. Form 12BB:

This form details your income and investments, helping your employer calculate the correct TDS.

Remember, accurate documentation is crucial to ensure your ITR is filed correctly, avoiding any potential discrepancies or issues with tax authorities.

To visit: https://www.mca.gov.in/

For further details access our website: https://vibrantfinserv.com