Relationship between QA and CA

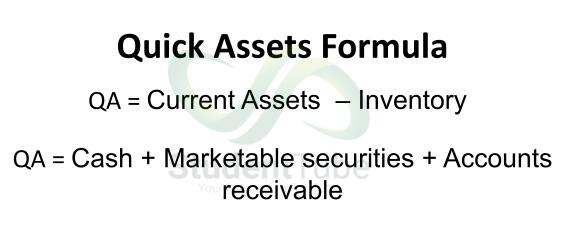

Quick assets are those current assets that can be easily converted into cash, such as cash, marketable securities, and accounts receivables. Current liabilities, on the other hand, are those obligations that are due within one year. Such as accounts payable, short-term loans, and accrued expenses. The relationship between quick assets and current liabilities is important because it reflects a company’s ability to meet its short-term obligations with its liquid assets. Relationship between QA and CA is friendly.

For more information visit this site: https://www.mca.gov.in/

The quick ratio, which can calculate by dividing the quick assets by the current liabilities, is a measure of a company’s liquidity and its ability to pay its short-term debts. A higher quick ratio indicates that a company has more liquid assets to cover its short-term obligations, which generally see as a positive sign by investors and creditors.