Introduction

Starting a business is a dream for many entrepreneurs, but legal complexities can often be overwhelming. Fortunately, a One-Person Company (OPC) provides a simplified way for solo entrepreneurs to establish a legally recognized business entity. An OPC combines the benefits of a sole proprietorship with the legal advantages of a private limited company, offering limited liability, ease of management, and business continuity.

If you’re wondering how to register an OPC, this guide will walk you through the process, benefits, limitations, usage, and frequently asked questions to help you make an informed decision.

Definition of a One-Person Company (OPC)

A One-Person Company (OPC) is a type of business entity that allows a single individual to own and operate a company with limited liability. Unlike a sole proprietorship, where the owner’s personal assets are at risk, an OPC provides legal separation between the owner and the business.

Key Features of an OPC:

- Owned and managed by a single individual.

- Limited liability protection for the owner.

- Separate legal identity from the owner.

- Requires a nominee director in case of the owner’s incapacity or death.

- Subject to fewer compliance requirements compared to private limited companies.

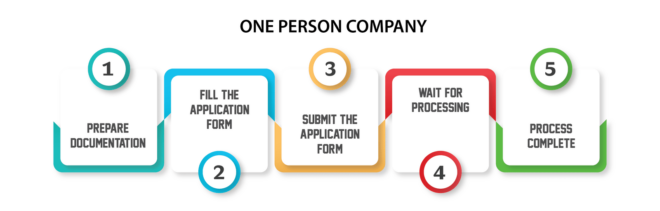

How to Register a One-Person Company (OPC)

Registering an OPC involves several legal steps. Below is a step-by-step guide to help you complete the registration process:

Obtain a Digital Signature Certificate (DSC)

- A DSC is required to file electronic documents for company registration.

- Obtain a DSC from a certified agency by submitting proof of identity and address.

Apply for Director Identification Number (DIN)

- The sole director of the OPC must apply for a Director Identification Number (DIN) through the government portal.

- DIN is a unique identification number required for company registration.

Name Approval for the Company

- Choose a unique name for the OPC following the naming guidelines set by the regulatory authority.

- Submit the name for approval through the Ministry of Corporate Affairs (MCA) portal.

Prepare Company Incorporation Documents

- Draft the Memorandum of Association (MoA) and Articles of Association (AoA) to define the objectives and internal management of the company.

- Appoint a nominee director in case the owner is unable to run the business.

File Incorporation Application (SPICe+ Form)

- Submit the SPICe+ Form (Simplified Proforma for Incorporating Company Electronically) with all necessary documents:

- PAN & Aadhar of the owner

- Address proof of the company’s registered office

- Declaration of compliance

Obtain Certificate of Incorporation

- Once the application is processed, the Registrar of Companies (ROC) issues a Certificate of Incorporation.

- The company is now legally registered.

Apply for PAN and TAN

- Apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) to comply with tax regulations.

Open a Business Bank Account

- Open a bank account in the company’s name to conduct business transactions.

Benefits of Registering a One-Person Company

Limited Liability Protection: Personal assets of the owner are protected from business liabilities.

Separate Legal Entity: OPC has its own legal identity, making it easier to raise funds and enter contracts.

Less Compliance Burden: Compared to private limited companies, OPCs have fewer compliance requirements.

Full Control of Business: The owner has complete decision-making authority.

Tax Benefits: OPCs enjoy certain tax benefits and deductions not available to sole proprietorships.

Business Credibility: A registered company gains trust and credibility with customers and investors.

Usage of a One-Person Company

OPCs are ideal for individuals who want to start a business without involving partners. It is commonly used in the following industries:

- Freelancers and Consultants: IT professionals, content creators, and marketing consultants.

- E-commerce and Startups: Entrepreneurs running online businesses.

- Service Providers: Lawyers, doctors, architects, and chartered accountants.

- Manufacturing and Trading: Small-scale manufacturers or traders looking for legal protection.

Limitations of a One-Person Company

Cannot Have More Than One Owner: An OPC can only have one shareholder, limiting expansion opportunities.

Higher Compliance Than Sole Proprietorship: Although less than a private limited company, OPCs still have compliance requirements.

Mandatory Conversion on Growth: If the OPC’s turnover exceeds a certain limit (varies by country), it must convert into a private limited company.

Limited External Funding: Investors prefer private limited companies over OPCs for funding.

Nominee Requirement: The owner must appoint a nominee, which can complicate management.

Comparative Table: OPC vs Other Business Structures

| Feature | One-Person Company (OPC) | Sole Proprietorship | Private Limited Company |

|---|---|---|---|

| Legal Identity | Separate legal entity | No separate entity | Separate legal entity |

| Ownership | Single owner | Single owner | Minimum 2 shareholders |

| Liability | Limited liability | Unlimited liability | Limited liability |

| Tax Benefits | Eligible for deductions | Personal tax slab | Eligible for deductions |

| Compliance Requirement | Moderate | Low | High |

| Conversion to Other Forms | Mandatory if turnover exceeds limit | Not required | No conversion required |

Conclusion

Registering a One-Person Company (OPC) is a great option for solo entrepreneurs looking for legal protection and business credibility. While it offers numerous advantages like limited liability, tax benefits, and ease of management, it also comes with compliance requirements and restrictions on ownership.

Before opting for an OPC, consider your business goals, legal requirements, and financial plans. If you aim to grow and attract investors, a private limited company might be a better choice. However, if you prefer full control and legal protection with minimal compliance, an OPC is the perfect option.

By following the step-by-step registration process and understanding its advantages and limitations, you can successfully establish an OPC and build a strong foundation for your business.

Frequently Asked Questions (FAQs)

1. Can I convert an OPC into a private limited company?

Yes, an OPC must convert into a private limited company if its turnover exceeds the prescribed limit.

2. How much time does it take to register an OPC?

Typically, OPC registration takes 7-10 business days, depending on document processing.

3. Can a foreign national register an OPC in my country?

Rules vary by country, but in most cases, a foreign national cannot register an OPC.

4. Is a nominee mandatory for an OPC?

Yes, the owner must appoint a nominee who will take over the business in case of death or incapacity.

5. What is the minimum capital required for an OPC?

Most countries do not have a minimum capital requirement for registering an OPC.

6. Can an OPC own property?

Yes, an OPC is a separate legal entity and can own property in its name.

7. Does an OPC need to file tax returns?

Yes, OPCs are required to file tax returns like any other registered business.

8. Can an OPC have multiple directors?

No, an OPC can only have one director and one nominee at any time.

9. What happens if the OPC owner dies?

The nominee appointed at the time of registration will take over the business.

10. Is an OPC suitable for startups?

Yes, OPCs are great for startups, especially if you plan to run the business alone

To Visit https://www.mca.gov.in