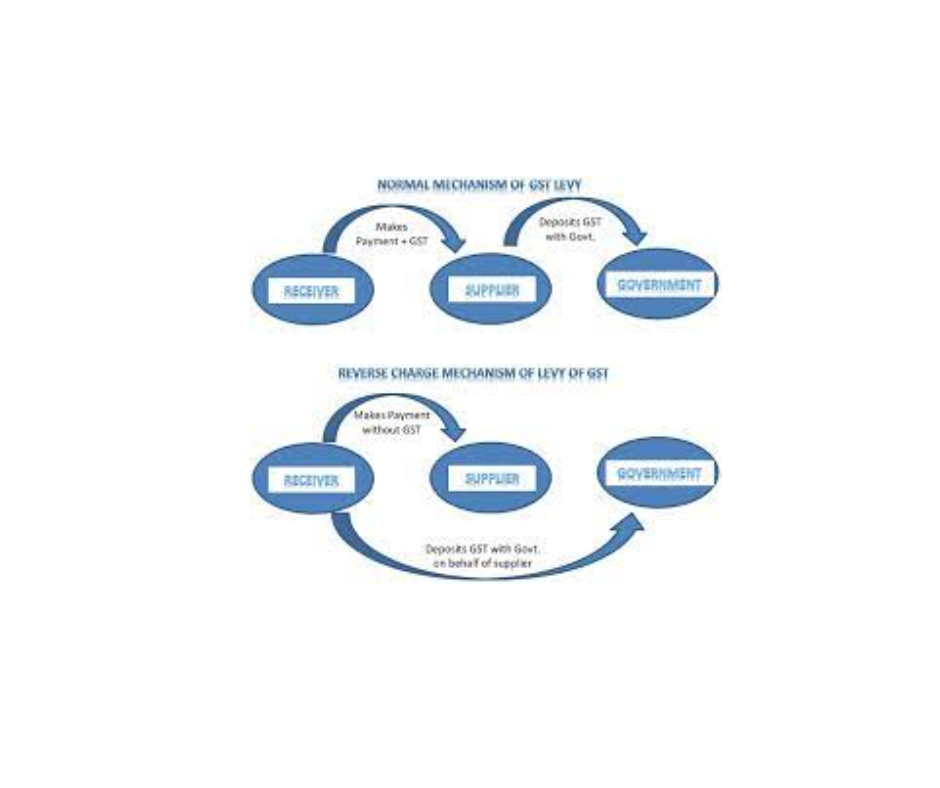

The RCM stands for Reverse Charge Mechanism in GST. The Reverse Charge Mechanism is a concept under GST wherein the recipient of goods or services is liable to pay the GST instead of the supplier. To put it differently, the Reverse Charge Mechanism necessitates that the individual receiving goods or services obliged to remit the GST directly to the government, as opposed to the supplier.

For more information to visit https://www.gst.gov.in/

The Reverse Charge Mechanism is applicable in certain specified cases such as purchases from unregistered dealers, purchases of certain goods and services. Goods from unregistered suppliers, legal and accounting services, and hiring of transport services from an unregistered dealer includes in it. The objective of the Reverse Charge Mechanism is to broaden the scope of taxable transactions and promote adherence to the regulations governing GST.