“Can you explain the significance of Liabilities on the balance sheet of a contractual service provider?

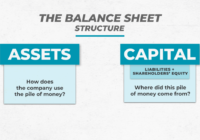

Liabilities on the Balance Sheet Liabilities on the balance sheet of a contractual service provider hold significant importance as they represent the financial obligations and debts that the company owes to external parties. These obligations arise from past transactions or events and require the company to provide economic benefits in the future. Here’s a… Read More »