Best Strategies for Paying Off Student Loans in the U.S.

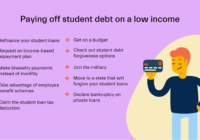

Introduction Student loans are a significant financial burden for many Americans. With rising tuition costs, many graduates find themselves struggling to repay their loans while managing other expenses. Paying off student loans efficiently can help reduce financial stress and free up money for other life goals. This guide explores the best strategies for paying off… Read More »