How do Motor & Truck Rental Services providers categorize and record expenses in their bookkeeping?

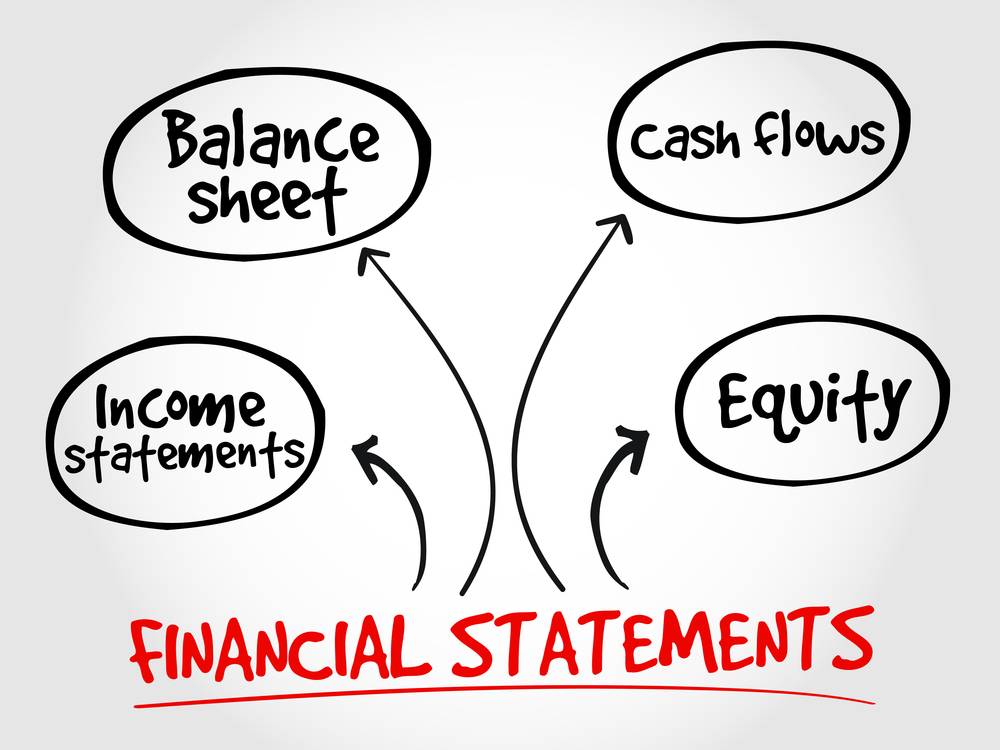

Expense Recording Methods Expense Recording Methods for Motor and truck rental service providers in India categorize and record expenses in their bookkeeping to effectively manage their business finances. They follow a systematic approach to ensure accurate accounting and compliance with taxation regulations. 1. Expense Categorization: Motor and truck rental service providers categorize expenses into… Read More »