NetWorth V/s LiquidCapital

NetWorth v/s LiquidCapital are both financial terms used to assess an individual’s or organization’s financial position, but they represent different aspects of financial resources. Here’s a comparison between the two: Net Worth: Net worth refers to the total value of an individual’s or organization’s assets minus its liabilities. It provides a snapshot of the overall financial standing by considering all assets owned and all debts owed.

1. Calculation:

Net worth is calculated by subtracting the total liabilities (such as loans, mortgages, and outstanding debts) from the total assets (including cash, investments, real estate, vehicles, and other valuables).

2. Significance:

Net worth represents the accumulated wealth or value of an entity. It helps assess financial health and long-term financial stability. A positive net worth indicates that assets exceed liabilities, while a negative net worth suggests the opposite.

3. Liquid Capital:

Liquid capital (also known as liquid assets or liquid funds) refers to the cash or easily convertible assets that an individual or organization has readily available for immediate use or investment.

4. Examples:

Liquid capital includes cash, bank account balances, short-term investments, stocks, bonds, and other highly liquid assets that can be quickly converted into cash without significant loss of value.

5. Significance:

Liquid capital represents the immediate financial resources available to meet day-to-day expenses, cover short-term liabilities, or seize investment opportunities. It reflects the financial liquidity and flexibility of an entity. Net worth vs liquid capital

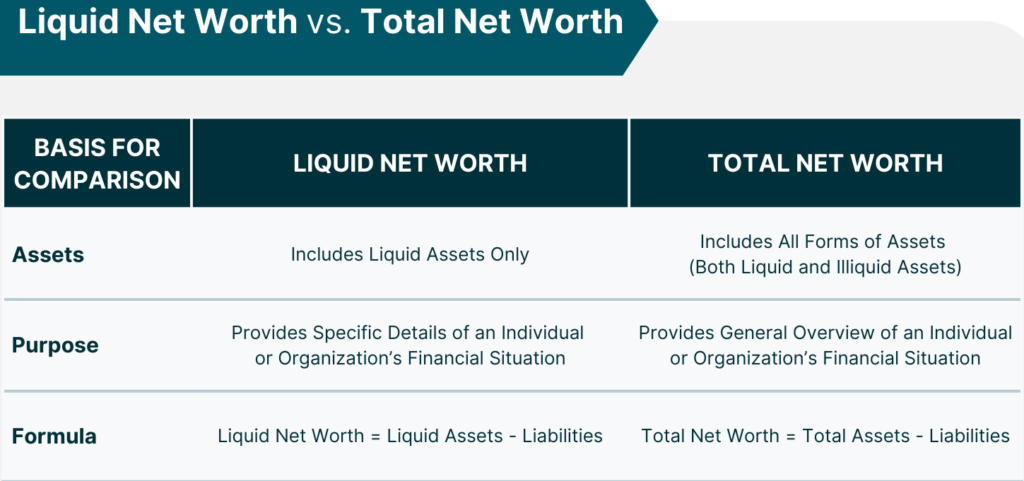

6. Differences Scope:

Net worth takes into account all assets and liabilities, including both liquid and non-liquid assets and long-term debts. It provides a comprehensive view of overall financial standing. Liquid capital, on the other hand, specifically refers to the cash and easily convertible assets that can be quickly accessed.

7. Time Frame:

Net worth represents a cumulative financial position at a specific point in time, considering all assets and liabilities up to that date. Liquid capital focuses on the immediate availability of cash and assets for short-term needs.

8. Purpose:

Net worth is typically used for assessing long-term financial stability, measuring wealth accumulation, and determining creditworthiness. Liquid capital is more relevant for evaluating short-term financial liquidity and the ability to meet immediate financial obligations. Net worth vs liquid capital

In summary, net worth reflects the overall financial position by considering all assets and liabilities, while liquid capital represents the immediate availability of cash and easily convertible assets. Both measures provide valuable insights into an individual’s or organization’s financial resources, but they serve different purposes and focus on different aspects of financial health.

FAQs:

- What is liquid capital?

- Liquid capital is the amount of cash or assets easily convertible to cash.

- How is net worth calculated?

- Net worth is calculated by subtracting total liabilities from total assets.

- Is net worth a measure of financial health?

- Yes, net worth indicates overall financial health and wealth.

- Is liquid capital a measure of immediate liquidity?

- Yes, liquid capital shows how quickly assets can be turned into cash.

- Can net worth include non-liquid assets?

- Yes, net worth includes both liquid and non-liquid assets like property.

- Does liquid capital include long-term investments?

- No, liquid capital excludes long-term investments and focuses on cash or assets quickly convertible to cash.

- How can one improve their net worth?

- One can improve net worth by increasing assets or reducing liabilities.

- How can one increase their liquid capital?

- One can increase liquid capital by saving more cash or selling non-essential assets

To visit: https://www.incometax.gov.in

For further details access our website: https://vibrantfinserv.com