Net Revenue and Gross profit

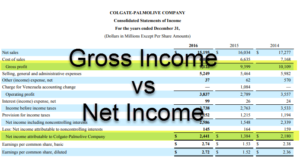

Net Revenue and Gross profit

Net revenue, also called net sales, refers to the total income a company generates from its operations after deducting certain items such as discounts, returns, and allowances. It represents the actual amount of money a business brings in from selling its goods or services.

- Formula for Net Revenue: Net┬ĀRevenue=Gross┬ĀSalesŌłÆReturnsŌłÆAllowancesŌłÆDiscounts\text{Net Revenue} = \text{Gross Sales} – \text{Returns} – \text{Allowances} – \text{Discounts}

HereŌĆÖs an example: If a company has $1,000,000 in gross sales but issues $50,000 in returns, $10,000 in discounts, and $5,000 in allowances, the net revenue would be:

1,000,000ŌłÆ(50,000+10,000+5,000)=935,0001,000,000 – (50,000 + 10,000 + 5,000) = 935,000

This $935,000 is the companyŌĆÖs net revenue.

What is Gross Profit?

Gross profit refers to the amount of money a business earns after deducting the cost of goods sold (COGS) from its net revenue. COGS includes all the direct costs involved in producing a product or delivering a service, such as materials, labor, and manufacturing expenses.

- Formula for Gross Profit: Gross┬ĀProfit=Net┬ĀRevenueŌłÆCost┬Āof┬ĀGoods┬ĀSold┬Ā(COGS)\text{Gross Profit} = \text{Net Revenue} – \text{Cost of Goods Sold (COGS)}

For example, if a company has $935,000 in net revenue and $400,000 in COGS, the gross profit would be:

935,000ŌłÆ400,000=535,000935,000 – 400,000 = 535,000

This $535,000 represents the companyŌĆÖs gross profit.

Key Differences Between Net Revenue and Gross Profits

1. Definition:

-

- Net Revenue is the total income after deducting discounts, returns, and allowances from gross sales.

- Gross Profit is the profit left after subtracting the cost of goods sold (COGS) from net revenue.

2. Purpose:

-

- Net Revenue gives an accurate picture of how much money the company has made through sales after all adjustments.

- Gross Profit helps measure how efficiently a company is producing its goods or services by showing how much profit remains after paying for the cost of production.

3. Impact on Financial Statements:

-

- Net Revenue is used as the starting point on the income statement to calculate gross profit, operating profit, and net income.

- Gross Profit is used to assess the core profitability of the business before overhead expenses like rent, utilities, and administrative costs are deducted.

4. Inclusions:

-

- Net Revenue focuses on sales activity and adjustments like discounts, returns, and allowances.

- Gross Profit focuses on both sales activity and the efficiency of production by considering the costs associated with making the product or delivering the service.

Why Net Revenue and Gross Profit Are Important

Understanding both net revenue and gross profits is crucial for evaluating a companyŌĆÖs financial health and efficiency.

- Net Revenue shows how successful a company is at generating sales, and is often used to compare year-over-year performance or against competitors.

- Gross Profit indicates how efficiently the company is managing its production or delivery costs, which is key to maintaining profitability as the company scales.

For example, a company with strong net revenue but low gross profit may struggle with high production costs, which could hurt its long-term profitability. Conversely, a company with high gross profit margins can reinvest in growth and operations more effectively.

To visit: https://www.incometax.gov.in

FAQs

1. What is net revenue?

Related┬Ā Topics

What qualifies as liquid net worth?

What is liquid net worth calculator ?

How do I determine my liquid net worth?

What is considered liquid net worth?

What is the difference between net worth, profit and turnover?

For further details visit:┬Āhttps://vibrantfinserv.com/service-detail-25.php

Contact:┬Ā┬Ā┬Ā┬Ā 8130555124, 8130045124

Whatsapp:┬Ā┬Āhttps://wa.me/918130555124

Mail ID:┬Ā┬Ā┬Ā┬Ā┬Ā┬Āoperations@vibrantfinserv.com

FB Link:┬Ā┬Ā┬Ā┬Ā┬Ā┬Āhttps://fb.me/vibrantfinserv

Insta Link:┬Ā┬Āhttps://www.instagram.com/vibrantfinserv2/

Twitter:┬Ā┬Ā┬Ā┬Ā┬Ā┬Āhttps://twitter.com/VibrantFinserv

Linkedin:┬Ā┬Ā ┬Āhttps://www.linkedin.com/in/vibrant-finserv-62566a259/