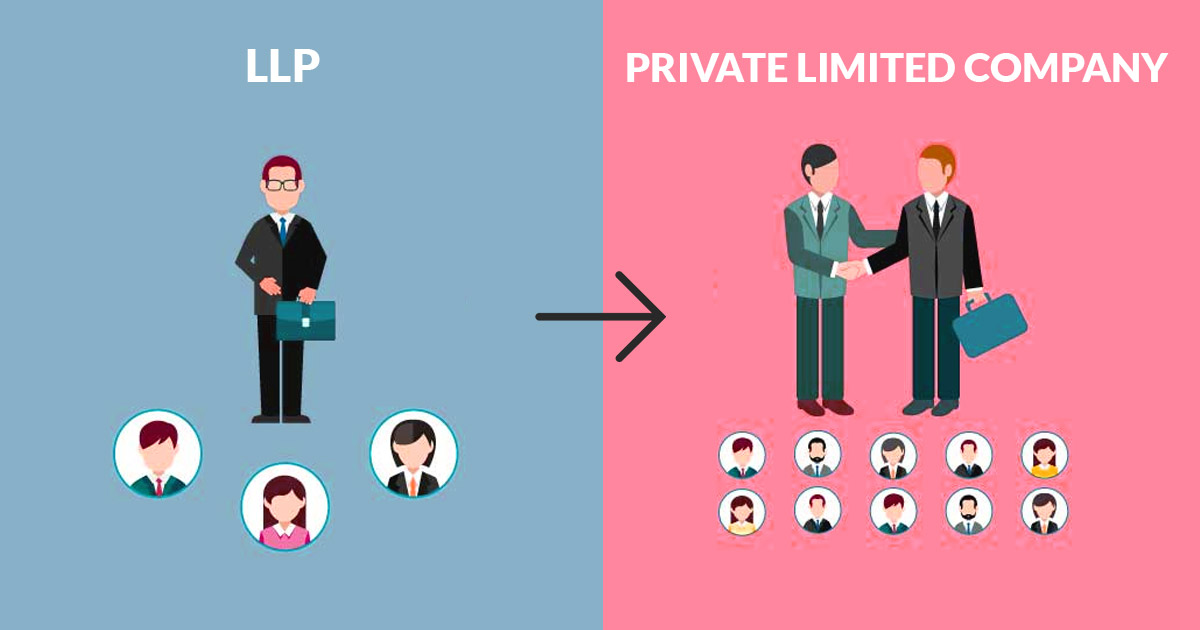

LLP to Company Conversion

LLP to Company Conversion

LLP to company conversion, In certain jurisdictions, such as India, it is feasible to convert a Limited Liability Partnership (LLP) into a company.

The process of converting an LLP to a company typically involves the following steps:

1. Board Resolution:

The partners of the LLP must pass a board resolution approving the conversion and authorizing designated partners to undertake the necessary actions for conversion.

2. Obtain DIN and DSC:

The designated partners of the LLP to company conversion need to obtain Director Identification Number (DIN) and Digital Signature Certificates (DSC) if they don’t already have them.

3. Name Reservation:

Choose a new name for the proposed company and apply for name reservation with the Registrar of Companies (ROC).

The chosen name must adhere to the specified naming guidelines and should be distinct from any preexisting companies or trademarks.

4. Prepare Documents:

Prepare the necessary documents required for conversion, including Memorandum of Association (MOA), Articles of Association (AOA), consent of partners for conversion, declaration by partners, and other required forms and affidavits.

5. File Conversion Application:

File the conversion application with the ROC, along with the required documents and prescribed fees.

The application should include details such as the proposed company structure, shareholding pattern, and other relevant information.

6. Compliance and Approval:

Comply with any additional requirements or conditions specified by the ROC. The application will be examined by the ROC, and if all requirements are met, they will issue a Certificate of Incorporation for the newly converted company.

It’s important to note that the specific procedures and requirements for converting an LLP to a company can vary depending on the jurisdiction and the legal framework governing such conversions.

It is advisable to consult with legal professionals or company secretaries who are well-versed in the laws and regulations of your jurisdiction to ensure compliance and a smooth conversion process.

To visit https://www.mca.gov.in

FAQs

For further details access our website https://vibrantfinserv.com