LLP is Defined Under Which Act

The Limited Liability Partnership (LLP) is a legal entity that is established and regulated by the Limited Liability Partnership Act of 2008.

This act provides the legal framework for the establishment, operation and regulation of LLPs in India.

LLP Act 2008 outlines the rights, duties, and obligations of partners. The act determine the process of formation and registration of LLPs, the management and operation of LLPs and other relevant provisions.

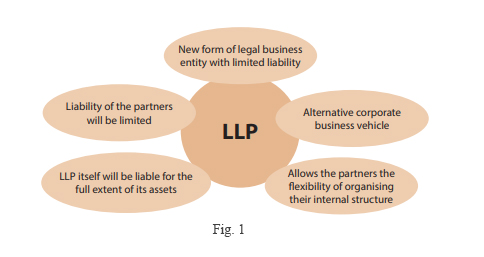

The LLP Act came into existence to introduce a business structure. That combines the advantages of limited liability with the flexibility and simplicity of partnerships.

It provides a separate legal entity status to LLPs, ensuring limited liability protection for the partners. It allows them to actively participate in the management and decision-making of the business .

However, The LLP Act sets out various provisions related to the incorporation and registration of LLPs. It requires for maintaining books of accounts, filing of annual returns, dissolution as well as winding up procedures pertaining to the functioning of LLPs.

Finally, It’s important to refer to the specific provisions of the LLP Act as well as any subsequent amendments or regulations issued by the government. It ensures compliance with the legal requirements applicable to LLPs in India.

To visit https://www.mca.gov.in

FAQs

-

What is an LLP?

- An LLP, or Limited Liability Partnership, is a business structure that combines the benefits of a partnership and a corporation, providing limited liability to its partners.

-

Which act governs LLPs in India?

-

-

- The LLP Act, 2008 aims to provide a legal framework for the formation and regulation of LLPs, ensuring their transparency and accountability.

-

When was the LLP Act enacted?

- The LLP Act was enact in India on April 1, 2009.

-

Who can form an LLP?

- Any two or more persons can form an LLP for carrying on a lawful business with a view to profit.

-

What is the main advantage of an LLP?

- The main advantage is Ltd liability, meaning partners are not personally liable for the debts of the LLP beyond their investment.

-

Are LLPs require to file annual returns?

- Yes, LLPs are require to file annual returns and maintain proper records as per the LLP Act.

-

Can an LLP convert into a company?

- Yes, an LLP can be convert into a company, following the procedure specified in the LLP Act.

-

How much capital is need to set up an LLP?

- There is no minimum capital requirement for setting up an LLP under the LLP Act.

-

Is an LLP tax as a partnership or a company?

- An LLP is tax as a partnership, meaning it is not subject to corporate tax, and partners are tax on their share of profits.

For further details access our website https://vibrantfinserv.com