User Intent

People searching for “LLP vs OPC” are likely entrepreneurs, small business owners, or professionals looking to understand which business structure suits their needs. They want a detailed comparison to make an informed decision regarding tax benefits, compliance requirements, liability, and operational ease.

Introduction

Choosing the right business structure is one of the most crucial decisions for any entrepreneur. Two popular options in India are Limited Liability Partnership (LLP) and One Person Company (OPC). While both offer distinct advantages, their suitability depends on business needs, ownership preferences, and compliance ease.

In this article, we will compare LLP and OPC step by step to help you make the right choice.

Definition

What is LLP?

A Limited Liability Partnership (LLP) is a hybrid business structure that combines the features of a partnership and a corporation. It provides the flexibility of a partnership with the added benefit of limited liability protection for its partners. LLPs are registered under the Limited Liability Partnership Act, 2008.

What is OPC?

A One Person Company (OPC) is a business entity where a single entrepreneur can operate as a separate legal entity. It provides the benefits of limited liability while allowing complete control to the sole owner. OPCs are governed under the Companies Act, 2013.

Application

When to Choose LLP?

- Ideal for professional services firms such as lawyers, accountants, and consultants.

- Suitable for small and medium-sized businesses looking for a corporate structure without rigid compliance.

- Recommended for businesses with multiple partners who want to share responsibilities and profits.

When to Choose OPC?

- Best for solo entrepreneurs who want full ownership while enjoying limited liability.

- Suitable for businesses that plan to scale later by adding more directors or converting to a private limited company.

- Ideal for startups and freelancers looking for a corporate identity.

Benefits

Benefits of LLP

Limited Liability Protection: Partners are not personally liable for business debts.

Less Compliance: Compared to a private limited company, LLP has fewer legal formalities.

Separate Legal Entity: An LLP can enter contracts and own property in its name.

No Minimum Capital Requirement: You can start an LLP with any amount of capital.

Tax Benefits: LLPs do not have dividend distribution tax (DDT), reducing tax burdens.

Benefits of OPC

Full Control: A single owner makes all decisions without external interference.

Limited Liability: Personal assets remain protected from business liabilities.

Corporate Image: Enhances credibility and trust among customers and investors.

Ease of Raising Funds: Banks and investors prefer dealing with incorporated entities.

Perpetual Existence: OPC remains active even if the owner changes.

Limitations in Detail

Limitations of LLP

Cannot Raise Equity Funds: LLPs cannot issue shares, making fundraising difficult.

Higher Taxation: LLPs are taxed at 30% on profits, plus surcharge and cess.

Annual Compliance: Though lower than a company, LLPs must file annual returns and financial statements.

Not Suitable for Large Businesses: LLPs are not ideal for businesses looking for venture capital funding.

Limitations of OPC

Single Ownership Restriction: Only one member is allowed; adding partners requires conversion to a private limited company.

Higher Compliance Costs: OPCs must file annual returns, conduct audits, and meet stricter regulations.

Limited Tax Benefits: Unlike LLPs, OPCs do not get exemptions under Presumptive Taxation (Section 44AD).

Conversion Restrictions: OPCs must convert into a private limited company once their turnover exceeds ₹2 crores.

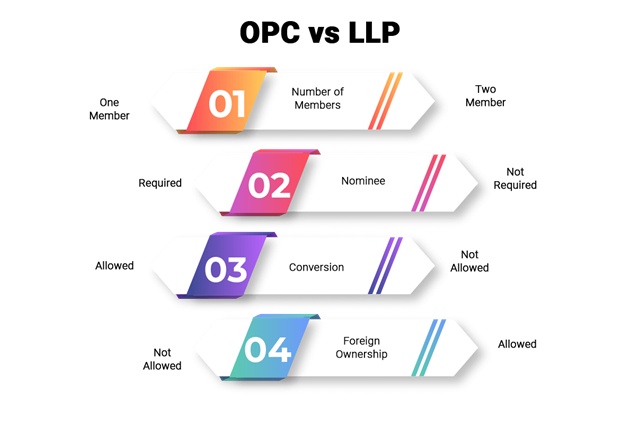

Comparative Table: LLP vs OPC

| Feature | LLP | OPC |

|---|---|---|

| Ownership | Minimum 2 partners | Only 1 person |

| Legal Status | Separate legal entity | Separate legal entity |

| Liability | Limited liability | Limited liability |

| Compliance Cost | Low | High |

| Taxation | 30% on profits | 25% on net profits |

| Fundraising | Cannot raise equity funds | Easier than LLP |

| Perpetual Existence | Yes | Yes, but linked to owner |

| Conversion | Can be converted to a company | Must convert if turnover > ₹2 Cr |

| Suitable for | Professionals, service firms, partnerships | Solo entrepreneurs, startups |

Conclusion

Both LLP and OPC have their own advantages and disadvantages.

- If you are a solo entrepreneur and want full control, OPC is a better choice.

- If you are starting a business with multiple partners, need flexibility, and want lower compliance costs, then LLP is the right option.

- If fundraising and scaling are priorities, you may consider registering a Private Limited Company instead.

Understanding these differences will help you make an informed decision that aligns with your business goals.

FAQs

1. Can an OPC have more than one owner?

No, an OPC is meant for a single entrepreneur. However, you can appoint a nominee director in case of unforeseen circumstances.

2. Can an LLP be converted into a private limited company?

Yes, an LLP can be converted into a private limited company by following the legal process under the Companies Act.

3. Is an LLP better than a partnership firm?

Yes, LLP is a better option than a traditional partnership firm because it provides limited liability protection to its partners.

4. Can an OPC raise investment?

An OPC cannot issue shares to raise equity capital. However, it can take loans and other forms of investment.

5. Which is more tax-efficient: LLP or OPC?

OPCs enjoy a lower corporate tax rate (25%), whereas LLPs are taxed at 30% on profits but benefit from not having to pay dividend distribution tax (DDT).

For further details access our website https://vibrantfinserv.com