![]()

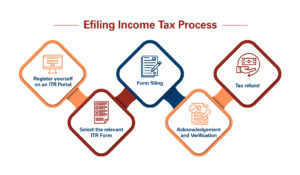

ITR Filings Process

The ITR filings process in India generally involves the following steps:

1. Gather the necessary documents:

Collect all the relevant documents such as Form 16 (if applicable), bank statements, investment proofs, rent receipts, and any other supporting documents related to your income, expenses, and deductions.

2. Choose the correct ITR form:

Determine the appropriate ITR form based on your income sources, residential status, and other relevant factors. The different ITR forms cater to different types of taxpayers and their specific situations.

3. Prepare the ITR:

Fill in the required information in the ITR form. Provide details about your income, deductions, exemptions, and any other relevant information as per the form’s instructions.

4. Compute the tax liability:

Calculate your total income, deductions, and taxable income. Use the applicable tax slabs and rates to determine the tax liability.

5. Pay any outstanding taxes:

If you have any tax liabilities remaining after considering TDS (Tax Deducted at Source) and advance tax payments, pay the outstanding amount before filing the ITR.

6. Validate the ITR:

Verify and cross-check all the information provided in the ITR form for accuracy and completeness. Ensure that the ITR is duly signed and dated.

7. Submit the ITR:

File the ITR electronically through the Income Tax Department’s e-filing portal. Depending on the ITR form, you may have the option to e-verify the ITR using Aadhaar OTP, net banking, or other methods. Alternatively, you can physically submit the ITR by mailing a signed copy to the Centralized Processing Center (CPC).

8. Acknowledgment and verification:

After successful submission, you will receive an acknowledgment called the ITR-V (Income Tax Return-Verification). If you filed the ITR electronically, you may need to verify it within a specified timeframe using the prescribed methods.

9. Verification completion:

Once the ITR is successfully verified, the filing process is complete. The Income Tax Department will process your return and issue any applicable refunds or communicate any discrepancies or queries.

It is important to note that the above steps provide a general overview of the ITR filings process. The specific details and requirements may vary based on individual circumstances, changes in tax laws, and the instructions provided by the Income Tax Department. It is recommended to consult with a tax professional or refer to the official Income Tax Department website for detailed and up-to-date guidance on the ITR filings process.

┬Ā

For more information visit this site: https://www.incometax.gov.in

For further details access our website https://vibrantfinserv.com/