Whether a managed fund is worth it depends on various factors and individual preferences.

Here are some considerations to help you evaluate the worth of a managed fund:

1. Professional Expertise:

These funds are typically managed by professional fund managers who have expertise in investment strategies and market analysis.

If you lack the time, knowledge, or interest to manage your investments actively, a managed fund can provide access to professional expertise and potentially generate better returns.

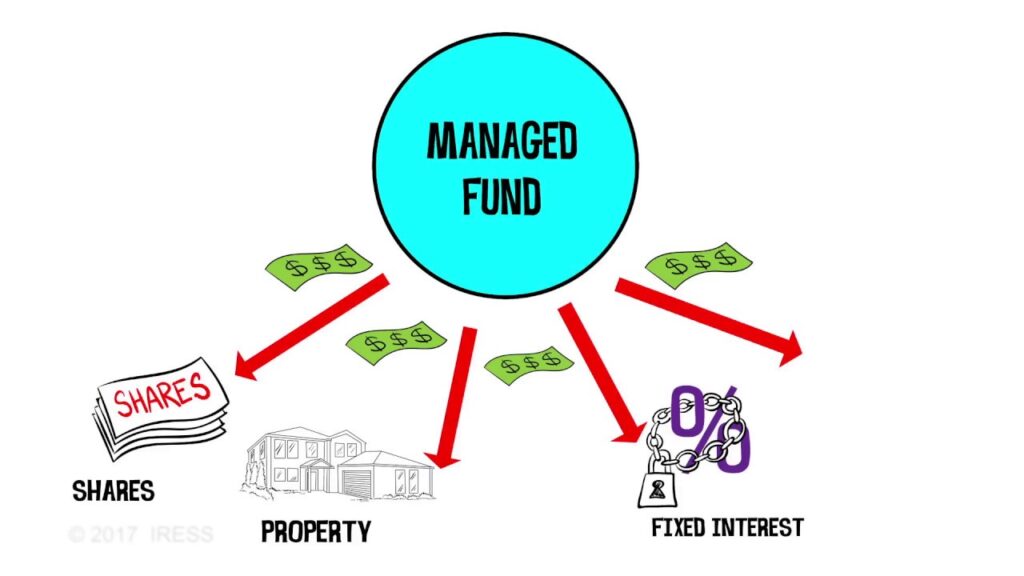

2. Diversification:

These funds often offer diversification by investing in a broad range of assets or across different sectors, geographies, or asset classes. This diversification can help spread risk and reduce the impact of individual investment fluctuations.

3. Convenience and Accessibility:

It provide convenience by handling the investment process, including research, buying and selling securities, and portfolio management.

They are accessible to investors with varying levels of investment capital, making it easier for individuals to enter the market without extensive financial knowledge.

4. Fees and Costs:

Consider the fees and expenses associated with it, such as management fees, administration fees, and performance fees.

Evaluate whether the potential benefits and returns justify the costs involved. Compare the fees with the fund’s historical performance and the fees charged by alternative investment options.

5. Investment Goals and Risk Tolerance:

Assess whether it aligns with your investment goals and risk tolerance. Different managed funds have varying objectives, such as growth, income, or capital preservation.

It’s essential to understand the fund’s investment strategy, asset allocation, and risk profile to ensure it matches your financial objectives and risk tolerance.

6. Performance and Track Record:

Evaluate the historical performance of the managed fund by analyzing its returns over different time periods. Consider the consistency of performance and compare it to relevant benchmarks and similar funds. Past performance does not guarantee future results, but it can provide insights into the fund’s track record.

7. Transparency and Reporting:

Review the fund’s reporting and transparency practices. Look for regular and comprehensive updates on the fund’s holdings, performance, fees, and any other relevant information. Transparent reporting helps you stay informed about your investment and make better-informed decisions.

8. Long-Term Investment Horizon:

These are often considered suitable for long-term investment goals due to their potential for compounding returns over time. If you have a long investment horizon and are willing to stay invested through market fluctuations, a managed fund can be a viable option.

It’s important to conduct thorough research, read the fund’s prospectus, and seek professional financial advice when evaluating whether a managed fund is worth it for your specific investment needs and objectives. Consider your risk tolerance, investment time frame, and individual circumstances to make an informed decision.

To visit: https://www.mca.gov.in

FAQs

-

What is a managed fund?

- A managed fund pools money from many investors to invest in various assets, managed by professional fund managers.

-

How do managed funds differ from index funds?

- Managed funds are actively managed by professionals aiming to outperform the market, while index funds aim to match market performance by tracking a specific index.

-

- Managed funds offer professional management, diversification, and access to investment strategies that individual investors may not have

-

Are there fees associated with managed funds?

- Yes, managed funds typically have management fees and other costs, which can reduce overall returns.

-

Can managed funds outperform the market?

- Some managed funds do outperform the market, but many do not. It relies on the expertise of the fund manager and the prevailing market conditions.

-

How do I choose a good managed fund?

- Look for funds with a strong track record, experienced managers, low fees, and investments that match your risk tolerance.

-

What are the risks of investing in managed funds?

- Risks include market risk, manager risk, and fee-related impacts on returns. There’s no guarantee of profit.

-

How does performance reporting work for managed funds?

- Managed funds typically provide regular performance reports showing returns, expenses, and comparisons to benchmarks.

-

Can I redeem my investment anytime?

- Most managed funds allow redemptions, but there may be fees or penalties for early withdrawal in some cases.

-

Are managed funds suitable for everyone?

- Managed funds can be suitable for many investors, especially those seeking professional management and diversification, but it’s important to consider personal financial goals and risk tolerance.

For further details access our website https://vibrantfinserv.com