Is a Discount an Asset or Liability?

Discounts are a common part of business transactions, but their impact on a company’s financial statements can be confusing. Are they considered assets or liabilities? Let’s clarify this briefly.

Discounts and Assets

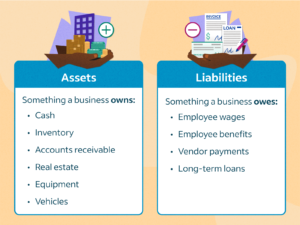

A discount is not typically classified as an asset. Assets represent things of value that a company owns or controls, which can generate future economic benefits, such as cash, equipment, or real estate. Discounts, on the other hand, don’t directly increase future economic benefits for a company in the way traditional assets do.

However, trade discounts (given on bulk purchases) can indirectly affect assets, as they reduce the cost of acquiring inventory or goods. By lowering purchase costs, the company retains more cash, which is an asset.

Discounts and Liabilities

A discount is also not typically a liability. Liabilities are obligations a company owes to others, like loans or unpaid bills. Discounts don’t represent future obligations but rather a reduction in revenue or expense.

However, discounts allowed (given to customers) reduce the amount of revenue the company will receive. This is treated as a reduction in sales income, not a liability, but it decreases the company’s profit margin.

Conclusion

A discount is neither an asset nor a liability. It’s usually treated as an adjustment to revenue or expenses. Discounts allowed (given to customers) reduce sales revenue, while discounts received (from suppliers) lower the cost of goods or services purchased. Both affect the company’s net income rather than being classified as assets or liabilities.

To visit: https://www.incometax.gov.in

FAQs

1.What is a discount?

- A discount is a reduction in the price of a product or service.

2. Is a discount an asset or liability?

- It depends. Discounts offered by a seller (sales discount) are an expense or reduction in revenue, while discounts received by a buyer (purchase discount) can reduce liabilities.

3. What is a sales discount?

- A sales discount is a reduction in the sales price given to customers for early payment or promotional purposes. It reduces revenue, not an asset or liability.

4. What is a purchase discount?

- A purchase discount is a reduction in the price a buyer pays for goods or services, usually for early payment. It reduces the buyer’s liability.

5. Is a discount received by a business an asset?

- No, a discount received reduces the amount owed to a supplier, so it decreases liabilities, not assets.

6. Is a discount allowed by a business a liability?

- No, a discount allowed reduces the revenue but is not a liability.

7. How do sales discounts affect financial statements?

- Sales discounts reduce total revenue on the income statement.

8. How do purchase discounts affect financial statements?

- Purchase discounts reduce the cost of goods sold (COGS) and the liabilities on the balance sheet.

9. Do discounts create future obligations?

- No, discounts generally do not create future obligations, so they are not liabilities.

10. Can a discount increase cash flow?

- Yes, if a purchase discount encourages early payment, it can improve cash flow by reducing liabilities quicker.

For further details access our website: https://vibrantfinserv.com