![]()

Income Tax Return

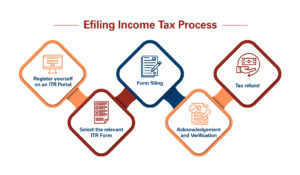

To file an Income Tax Return (ITR), you can follow these steps:

1. Gather the Required Documents:

Collect all the necessary documents, such as PAN card, Aadhaar card, bank statements, salary slips, Form 16 (if available), investment proofs, and other relevant financial documents.

2. Choose the Correct ITR Form:

Select the appropriate ITR form based on your income sources, such as ITR-1 (Sahaj) for salaried individuals, ITR-2 for individuals with income from other sources, ITR-3 for business owners, etc. Ensure that you select the correct form that matches your income and financial situation.

3. Prepare Your Income Details:

Calculate your total income for the financial year from all sources, including salary, business income, capital gains, house property income, and other income. Consider deductions and exemptions that you are eligible for under the Income Tax Act.

4. Fill in the ITR Form:

Enter the required information in the ITR form, such as personal details, income details, tax computation, deductions, and exemptions. Ensure that you accurately enter all the information as per the supporting documents.

5. Validate and Generate XML File:

Validate the filled-in ITR form and generate an XML file. The validation process ensures that the form is error-free and ready for submission.

6. Submit ITR:

Visit the Income Tax Department’s e-filing portal (https://www.incometaxindiaefiling.gov.in/) and log in using your credentials. Select the appropriate assessment year and upload the generated XML file. Review the information and submit the ITR.

7. Verify ITR:

After submission, you need to verify your ITR. This can be done electronically through methods like Aadhaar OTP, net banking, or by sending a signed physical copy of the ITR-V (Acknowledgment) to the Income Tax Department.

8. Keep a Copy:

Once the ITR filing process is successfully done and verified, make sure to keep a copy of the filed ITR and the acknowledgement receipt for future reference.

It is advisable to consult a tax professional or chartered accountant if you have complex tax situations or if you need assistance in filing your ITR accurately. They can provide guidance and help ensure compliance with tax laws.

For more information visit this site: https://www.incometax.gov.in

For further details access our website https://vibrantfinserv.com/