HUF Rules

HUF Rules

Huf rules,The rules governing a Hindu Undivided Family (HUF) in India are primarily derived from Hindu law and have been shaped by various court decisions and legal provisions.

Here are some key rules and principles associated with HUF:

Membership:

An HUF consists of a common ancestor (known as the Karta) and his lineal descendants. Both male and female members can be part of the HUF, including unmarried daughters and even married daughters under certain conditions.

Ancestral Property:

HUf rules typically holds ancestral property, which is property inherited from the common ancestor. It includes property received through inheritance, partition, or other sources recognized under Hindu law.

Co-parcenary:

The concept of co-parcenary refers to the joint ownership and coparcenary rights of male members in the ancestral property. Each male member, by birth, acquires an equal share in the property.

Karta:

The Karta is the head of the HUF and has the authority to manage the affairs and assets of the HUF. The Karta is usually the eldest male member, but in the absence of a male member, a female member can also become the Karta.

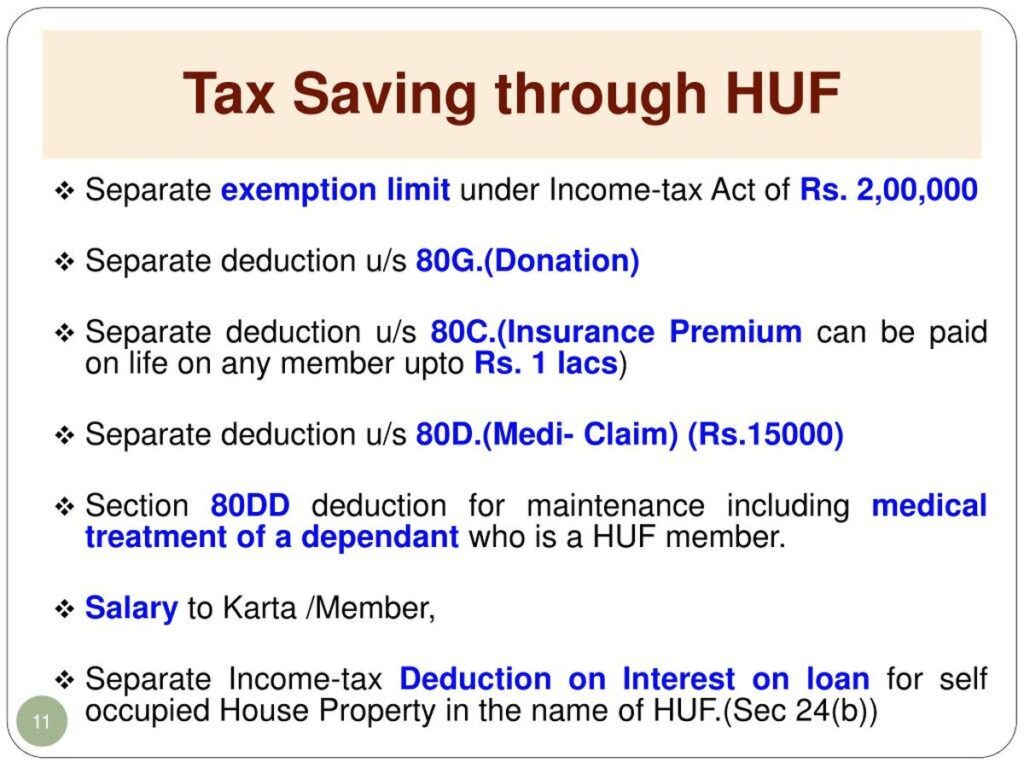

Income Tax:

HUf rules is recognize as a separate taxable entity under Indian tax laws. It requires obtaining a separate Permanent Account Number (PAN) and filing income tax returns.

Partition:

Partition refers to the division of HUF assets among its members. Any member, including the Karta, can seek a partition, resulting in the division of the HUF property into individual shares.

Succession and Inheritance:

In the event of the death of a coparcener, their share in the HUF property is pass on to their legal heirs as per the Hindu Succession Act, 1956.

It is important to note that specific rules and provisions may vary depending on various factors, including personal circumstances, regional customs.

And legal developments. Consulting with legal professionals or experts in Hindu law can provide more detail and accurate information based on your specific situation.

FAQs: