User Intent

Understanding how to utilize funds effectively is essential for individuals, businesses, and organizations. Whether you’re managing personal finances, running a business, or overseeing a nonprofit, proper fund utilization can lead to growth, stability, and financial security. This guide provides an in-depth approach to ensuring funds are used wisely, maximizing benefits while minimizing risks.

Introduction

Efficient fund utilization is the backbone of financial success. Without a strategic approach, money can be wasted, leading to financial instability and missed opportunities. This guide covers everything you need to know—from defining fund utilization to its applications, benefits, limitations, and comparisons with alternative financial strategies. Let’s dive into the details to help you make the most of your funds.

Definition of Fund Utilization

Fund utilization refers to the process of allocating and managing financial resources in a way that maximizes returns while maintaining financial stability. It involves strategic planning, budgeting, investing, and expense management to achieve financial goals effectively.

Key Aspects of Fund Utilization:

- Budgeting: Planning income and expenses efficiently.

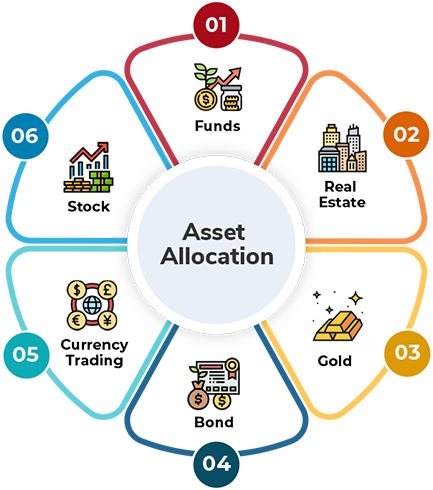

- Investing: Allocating funds to assets that generate returns.

- Cost Control: Reducing unnecessary expenditures.

- Debt Management: Using borrowed money wisely.

- Financial Planning: Setting long-term financial goals.

Application of Fund Utilization in Detail

Effective fund utilization applies to various financial aspects, including personal finance, business management, and organizational funding. Here’s a detailed look at its applications:

1. Personal Finance

- Budgeting: Create a monthly budget to track income and expenses.

- Saving & Investing: Allocate a portion of income to savings accounts, mutual funds, or stocks.

- Debt Management: Pay off high-interest debts before spending on luxuries.

- Emergency Funds: Keep at least six months’ worth of expenses saved.

- Retirement Planning: Invest in pension funds or retirement accounts.

2. Business Finance

- Capital Allocation: Assign funds to various departments for smooth operations.

- Investment in Growth: Invest in marketing, technology, and employee development.

- Operational Costs: Optimize expenses to avoid unnecessary spending.

- Profit Reinvestment: Use profits for expansion and research.

- Risk Management: Set aside funds for unforeseen business challenges.

3. Nonprofit Organizations

- Fundraising Management: Ensure collected funds are used for intended purposes.

- Operational Efficiency: Minimize administrative costs while maximizing impact.

- Program Development: Allocate funds to projects with the highest community benefit.

- Transparency & Reporting: Maintain clear financial records for donors and stakeholders.

Benefits of Proper Fund Utilization

Implementing a well-planned fund utilization strategy brings numerous advantages:

1. Financial Stability

Proper allocation ensures that funds are available when needed, reducing financial stress.

2. Maximized ROI (Return on Investment)

Investing wisely leads to increased profitability and financial growth.

3. Risk Mitigation

Having a clear fund management strategy helps in handling financial uncertainties effectively.

4. Increased Savings & Wealth Creation

Smart fund utilization allows individuals and businesses to grow their wealth over time.

5. Better Decision-Making

With a structured financial approach, one can make informed and strategic financial decisions.

Limitations of Fund Utilization

Despite its benefits, there are challenges that come with fund utilization.

1. Market Uncertainties

Investments can be affected by market fluctuations, leading to financial losses.

2. Mismanagement Risks

Poor financial planning or lack of expertise can lead to fund misallocation.

3. Inflation Impact

The value of money depreciates over time, affecting the effectiveness of fund utilization strategies.

4. Regulatory & Compliance Issues

Businesses and organizations must comply with financial regulations, which can sometimes be complex.

5. Limited Resources

Not everyone has access to large funds, limiting their ability to diversify investments effectively.

Comparative Table: Fund Utilization vs. Poor Fund Management

| Aspect | Effective Fund Utilization | Poor Fund Management |

|---|---|---|

| Financial Growth | Increases wealth & stability | Leads to financial decline |

| Risk Management | Prepares for uncertainties | Leaves finances vulnerable |

| Savings & Investments | Ensures future security | Lacks long-term planning |

| Debt Handling | Uses debt strategically | Leads to unnecessary debt |

| Decision-Making | Based on data & planning | Impulsive & unstructured |

| Regulatory Compliance | Adheres to financial laws | Risks legal & financial issues |

Conclusion

Utilizing funds effectively is crucial for financial growth, stability, and security. Whether for personal, business, or nonprofit use, proper allocation, budgeting, investing, and risk management ensure long-term success. While challenges exist, strategic planning helps mitigate risks and optimize financial outcomes. By understanding and applying these principles, you can make informed decisions that lead to financial prosperity.

Frequently Asked Questions (FAQs)

1. Why is fund utilization important?

Fund utilization ensures financial stability, growth, and security by strategically allocating money to essential expenses, investments, and savings.

2. What are the best ways to utilize funds?

Budgeting, investing in assets, reducing unnecessary expenses, and maintaining an emergency fund are the best ways to use funds wisely.

3. How can businesses optimize fund utilization?

By reinvesting profits, reducing operational costs, maintaining a cash reserve, and following a structured budget.

4. What are common mistakes in fund utilization?

Overspending, poor investment choices, lack of budgeting, and ignoring risk management strategies.

5. How does poor fund utilization impact businesses and individuals?

It can lead to financial instability, unnecessary debt, poor credit ratings, and lack of savings for emergencies or future investments.