Introduction

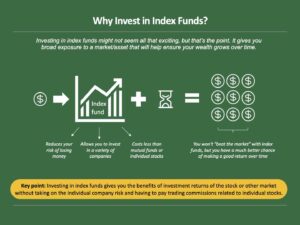

Investing in index funds is one of the easiest and most effective ways to build wealth over time. For beginners in the USA, index funds provide diversification, lower costs, and consistent returns. This guide will help you understand how to invest in index funds step by step, covering user intent, benefits, application, limitations, and FAQs.

Definition

An index fund is a type of mutual fund or exchange-traded fund (ETF) designed to replicate the performance of a specific market index, such as the S&P 500. These funds hold a diversified portfolio of stocks or bonds, reducing risk while offering market-average returns.

Application

Steps to Invest in Index Funds

- Understand Index Funds: Learn about different index funds like S&P 500, Total Stock Market, and sector-specific funds.

- Set Investment Goals: Determine your financial goals, such as retirement savings, wealth accumulation, or passive income.

- Choose a Brokerage Account: Open an account with brokers like Vanguard, Fidelity, Schwab, or Robinhood.

- Select an Index Fund: Pick an index fund based on expense ratio, historical performance, and investment strategy.

- Decide Investment Amount: Choose a lump sum investment or dollar-cost averaging strategy.

- Buy the Index Fund: Purchase shares through your brokerage platform.

- Monitor and Rebalance: Periodically review your portfolio and rebalance if needed.

Benefits

- Diversification: Index funds spread risk across multiple assets.

- Low Costs: Minimal management fees compared to actively managed funds.

- Consistent Returns: Historically, index funds outperform actively managed funds over the long term.

- Easy to Manage: No need for constant trading or stock picking.

- Passive Investment Strategy: Ideal for long-term, hands-off investors.

- Tax Efficiency: Lower capital gains taxes due to fewer transactions.

Usage

Who Should Invest in Index Funds?

- Beginners: Those new to investing who want a simple, effective strategy.

- Long-Term Investors: Individuals focused on retirement or wealth accumulation.

- Passive Investors: Those who prefer minimal management and stable growth.

- Cost-Conscious Investors: People looking to reduce fees and expenses.

Cooperative Table: Best Index Funds for Beginners in the USA

| Index Fund | Expense Ratio | Minimum Investment | Best For |

|---|---|---|---|

| Vanguard S&P 500 ETF (VOO) | 0.03% | No minimum | Broad market exposure |

| Fidelity ZERO Total Market Index Fund (FZROX) | 0.00% | No minimum | Fee-free investing |

| Schwab S&P 500 Index Fund (SWPPX) | 0.02% | No minimum | Low-cost investing |

| iShares Core S&P 500 ETF (IVV) | 0.03% | No minimum | Large-cap stocks |

| Vanguard Total Stock Market Index Fund (VTSAX) | 0.04% | $3,000 | Comprehensive U.S. market exposure |

Limitations

- Market Volatility: Index funds fluctuate with the overall market.

- Limited Growth Potential: No chance to outperform the market.

- Lack of Active Management: No professional oversight to adjust for changing conditions.

- Dividend Yields May Vary: Returns depend on market trends and index performance.

- Requires Long-Term Commitment: Best suited for patient investors.

Conclusion

Investing in index funds is a smart choice for beginners in the USA looking for a simple, cost-effective way to grow wealth. With low fees, diversification, and ease of use, index funds provide a strong foundation for financial security. By choosing the right funds, staying patient, and investing consistently, anyone can build long-term financial success.

FAQs

-

What is an index fund?

- An index fund is a type of mutual fund or ETF that tracks a specific market index.

-

Are index funds good for beginners?

- Yes, they offer diversification, low costs, and easy management.

-

How much money do I need to invest in index funds?

- Some funds require no minimum investment, while others start at $3,000.

-

What is the best index fund for beginners?

- Vanguard S&P 500 ETF (VOO) and Fidelity ZERO Total Market Index Fund (FZROX) are great choices.

-

How do I open an account to invest in index funds?

- You can open a brokerage account with firms like Vanguard, Fidelity, or Schwab.

-

Can I lose money in index funds?

- Yes, market fluctuations can cause temporary losses, but long-term investments generally yield positive returns.

-

How do I make money from index funds?

- Through capital appreciation and dividends.

-

What is the average return on index funds?

- Historically, S&P 500 index funds return around 7-10% annually.

-

Should I invest in multiple index funds?

- Diversifying among different index funds can help reduce risk.

-

Can I buy index funds with a 401(k) or IRA?

- Yes, many retirement accounts offer index funds as an investment option.

-

What is an expense ratio?

- It is the fee charged by fund managers, expressed as a percentage of assets.

-

Is now a good time to invest in index funds?

- Long-term investing minimizes timing risks, so it’s always a good time to start.

-

How often should I check my index fund investments?

- Quarterly reviews are sufficient for most investors.

-

Are index funds better than actively managed funds?

- Over time, most index funds outperform actively managed funds due to lower fees.

-

Can I withdraw money from my index fund anytime?

- Yes, but be aware of capital gains taxes and potential penalties in retirement accounts.

-

Do index funds pay dividends?

- Some index funds pay dividends based on the stocks they hold.

-

Should I reinvest dividends in my index fund?

- Reinvesting dividends can accelerate wealth growth over time.

-

What is dollar-cost averaging?

- Investing a fixed amount regularly to reduce the impact of market volatility.

-

How can I minimize taxes on index fund investments?

- Invest in tax-advantaged accounts like Roth IRAs and hold investments long-term.

-

Can I invest in international index funds?

- Yes, funds like Vanguard Total International Stock Index Fund (VTIAX) provide global exposure.

By following this guide, beginners in the USA can confidently start investing in index funds, benefiting from a proven strategy for long-term financial growth.

Related Topics:-

How Can I Quickly Improve My Credit Score in the U.S.A

How to Refinance Student Loans with Bad Credit in the USA?

Best Credit Cards for Cash Back Rewards in the U.S.A

Best high-yield savings accounts 2025

For further details access our website https://vibrantfinserv.com/

To visit: https://www.mca.gov.in/

Contact:ﺡ ﺡ ﺡ ﺡ 8130555124, 8130045124

Whatsapp:ﺡ ﺡ https://wa.me/918130555124

Mail ID:ﺡ ﺡ ﺡ ﺡ ﺡ ﺡ operations@vibrantfinserv.com

Web Link:ﺡ ﺡ ﺡ https://vibrantfinserv.com

FB Link:ﺡ ﺡ ﺡ ﺡ ﺡ ﺡ https://fb.me/vibrantfinserv

Insta Link:ﺡ ﺡ https://www.instagram.com/vibrantfinserv2/