![]()

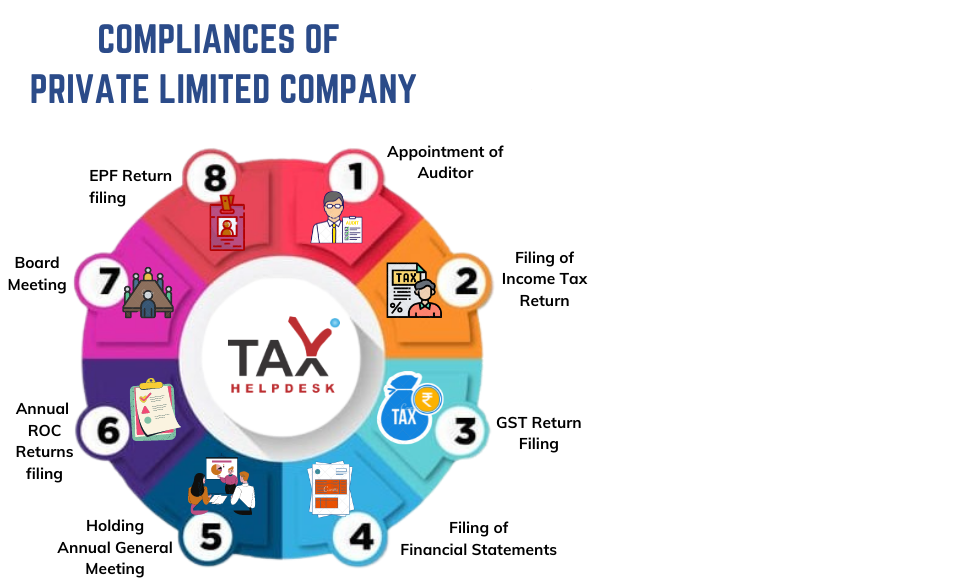

How to do GST compliance for private limited company

Compliance with GST for a private limited company entails meeting the prescribed guidelines and fulfilling the requirements of the Goods and Services Tax (GST) as established by the tax authority.

Here are some key aspects of GST for Private limited company:

GST Registration:

If your company meets the turnover threshold specified by the tax authority, it must register for GST. The registration process involves providing the necessary information and documents to obtain a GST registration number.

Tax Invoicing:

A private limited company must issue proper tax invoices for all taxable supplies made to customers. The tax invoices should include specific details required by the tax authority, such as the GST registration number, invoice number, date of supply, description of goods or services, quantity, value, and applicable tax rates.

GST Returns Filing:

The company needs to file regular GST returns, which involves reporting its sales, purchases, and GST liabilities for a specific period. The frequency of GST return filing varies by country, but it is typically monthly, quarterly, or annually.

To visit https://www.gst.gov.in/

Input Tax Credit (ITC) Claim:

A private limited company can claim Input Tax Credit for the GST paid on its purchases. It is essential to maintain proper records of purchase invoices and comply with the rules regarding eligible ITC claims.

Compliance with GST Regulations:

The company must adhere to various GST regulations, such as maintaining proper records of transactions, following specific invoicing and reporting requirements, and complying with anti-profiteering provisions if applicable.

Timely Payment of GST:

The company needs to pay the GST liability within the prescribed due dates to avoid penalties or interest charges.

GST Audits and Assessments:

The tax authority may conduct GST audits or assessments to ensure compliance. It is crucial for the company to maintain accurate records and documentation to support the information provided in the GST returns.

It is advisable for a private limited company to consult with a tax professional or refer to the guidelines provided by the tax authority in their respective country for detailed information on GST for Private limited company. These requirements may vary depending on the specific jurisdiction and its GST laws.

For further details access our website https://vibrantfinserv.com