Goods and Services Tax (GST) is a destination-based tax system that has replaced multiple indirect taxes in India. One of the fundamental features of GST is the seamless availability of Input Tax Credit (ITC), which helps businesses reduce their tax liability and avoid cascading effects. Understanding how GST input credit works is crucial for businesses to ensure compliance and optimize tax benefits.

This article provides an in-depth overview of ITC, including its eligibility, claim process, conditions, restrictions, and common issues businesses face.

What is Input Tax Credit (ITC)?

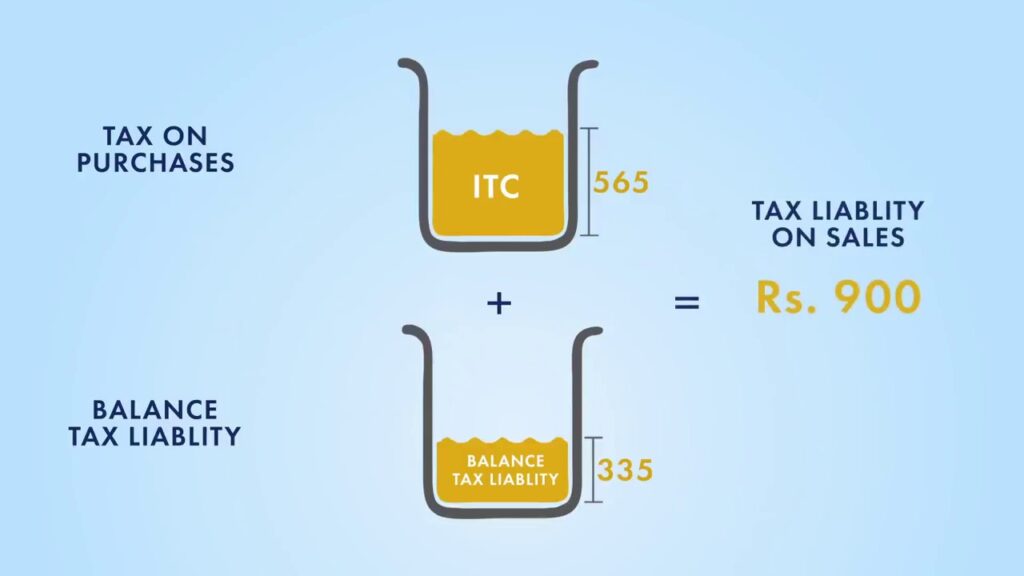

Input Tax Credit (ITC) is the credit of GST paid on the purchase of goods or services used for business purposes. It allows businesses to reduce the tax they have paid on inputs from the tax they need to pay on output supplies, ultimately lowering the overall tax burden.

For example:

- A manufacturer pays ₹10,000 as GST on raw materials.

- The manufacturer collects ₹15,000 as GST on the sale of finished goods.

- By utilizing ITC, the manufacturer can deduct ₹10,000 from ₹15,000 and pay only ₹5,000 as tax.

This mechanism prevents the cascading effect of taxation (tax on tax) and makes the tax system more efficient.

Eligibility for Claiming ITC

Under Section 16 of the CGST Act, 2017, ITC can be claimed only when the following conditions are met:

- Possession of a Tax Invoice: The taxpayer must have a valid tax invoice, debit note, or any other prescribed document issued by a registered supplier.

- Receipt of Goods or Services: The goods or services for which ITC is claimed must have been received.

- Tax Payment by Supplier: The supplier must have paid the GST to the government.

- Filing of GST Returns: The recipient must file GST returns (GSTR-3B and GSTR-2B) and furnish details of the ITC claim.

- Utilization for Business Purposes: The ITC should be used for further business operations and not for personal use or exempt supplies.

How to Claim ITC?

To claim ITC, businesses need to follow these steps:

Step 1: Ensure Supplier Compliance

ITC can only be claimed if the supplier has:

- Filed GSTR-1 (Outward Supply Details)

- Paid the tax to the government

- Reported the correct invoice details in GSTR-1

The recipient must verify whether ITC details appear in GSTR-2B, an auto-generated form that provides ITC eligibility.

Step 2: Match ITC with GSTR-2B

- The ITC details in GSTR-2B should match the taxpayer’s purchase records.

- Any discrepancies must be resolved by contacting the supplier.

Step 3: Claim ITC in GSTR-3B

- The eligible ITC is reported under the relevant heads in GSTR-3B.

- The total ITC available is reduced from the GST liability before making payment.

Step 4: Maintain Proper Records

Proper documentation of invoices, debit notes, and GST payments is crucial for audit purposes and ITC verification.

Types of Input Tax Credit

There are different types of ITC available under GST:

- ITC on Inputs: GST paid on raw materials or goods used for production.

- ITC on Input Services: GST paid on services like consulting, advertising, and rent.

- ITC on Capital Goods: GST paid on machinery, tools, or equipment used for business.

Restrictions and Blocked Credits

Despite the benefits of ITC, certain inputs and services are not eligible for credit under Section 17(5) of the CGST Act. These include:

- Motor Vehicles (unless used for transportation, training, or commercial use)

- Food, Beverages, and Catering Services

- Health and Life Insurance (unless mandated by law)

- Works Contract Services (except when used for plant and machinery)

- Membership of Clubs and Recreation Services

- Goods Lost, Stolen, or Destroyed

- Tax Paid under Composition Scheme

ITC Utilization Rules

ITC can be used to pay GST liabilities in a specific order:

- IGST Credit: Used first to pay IGST, then CGST, and then SGST.

- CGST Credit: Used to pay CGST and then IGST.

- SGST Credit: Used to pay SGST and then IGST.

- ITC Cannot be Used for Cash Payments: ITC cannot be used to pay interest, penalties, or late fees; these must be paid in cash.

ITC Reversal Situations

Businesses must reverse ITC in certain situations, including:

- Non-Payment to Supplier: If payment is not made to the supplier within 180 days, the ITC claimed must be reversed.

- Goods or Services Used for Exempt Supplies: If ITC is claimed on inputs used for exempt or non-business purposes, it must be reversed.

- Credit Notes Issued by Supplier: If the supplier issues a credit note, ITC must be reversed accordingly.

- ITC Claimed in Excess: Any excess ITC claimed must be reversed along with applicable interest.

ITC on Special Cases

1. ITC on Import of Goods and Services

- ITC can be claimed on the IGST paid during import by filing a bill of entry.

- The business must have an import invoice and comply with customs regulations.

2. ITC on Job Work

- ITC can be claimed on goods sent for job work if they are returned within 1 year (for inputs) or 3 years (for capital goods).

3. ITC for Banking and Financial Institutions

- Banks and NBFCs can claim ITC on 50% of eligible inputs.

Common Issues and Challenges in Claiming ITC

Despite the well-structured ITC mechanism, businesses often face challenges such as:

- Mismatch Between GSTR-2B and Books: Differences between reported ITC and the supplier’s returns can lead to ITC rejection.

- Delayed Refund Processing: ITC refunds may take time due to government verification.

- Supplier Non-Compliance: If the supplier does not pay GST, the buyer cannot claim ITC.

- Complex ITC Reversal Rules: Frequent reversals and recalculations add to compliance costs.

Recent Amendments and Developments

The government regularly updates ITC rules to improve compliance and reduce fraud. Some key developments include:

- Restricted ITC Claims: Businesses can claim ITC only if it appears in GSTR-2B.

- Stringent Action Against Fake Invoices: The GST authorities have increased scrutiny on fake ITC claims.

- Automatic ITC Matching: Future updates may include automated ITC reconciliation to simplify compliance.

Conclusion

GST Input Tax Credit is a crucial aspect of the GST framework, allowing businesses to reduce their tax liability and enhance cash flow. However, businesses must ensure proper documentation, verify ITC eligibility, and comply with GST return filings. Staying updated on ITC rules and addressing compliance challenges will help businesses optimize their tax benefits while avoiding penalties.

By understanding the ITC mechanism in detail, businesses can make informed financial decisions, reduce costs, and maintain seamless compliance under the GST regime.

For more such articles, visit us at: https://vibrantfinserv.com/kb/

For more info on GST, please visit: https://gst.gov.in/