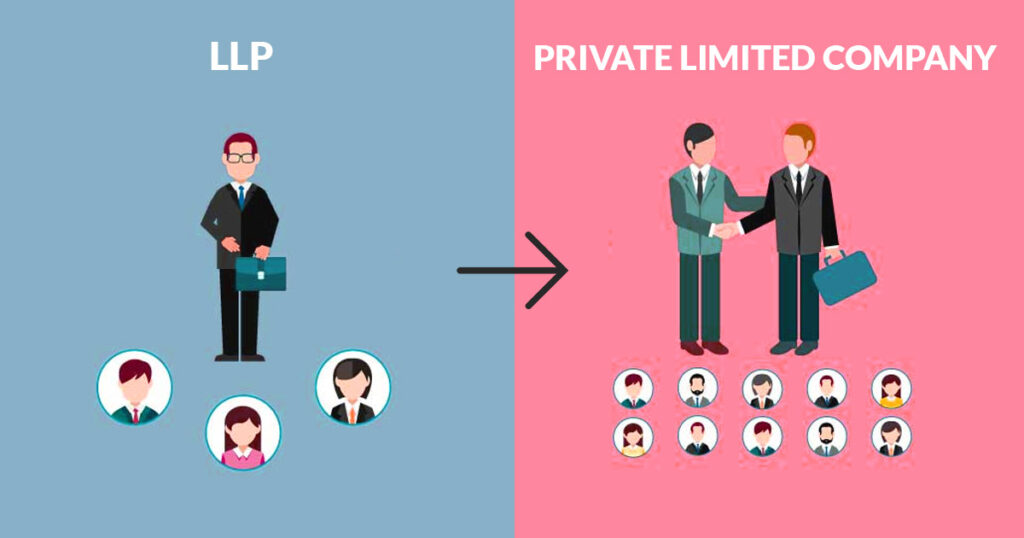

Step 1: Understand the Difference Between an LLLP and a Private Company

Before initiating the conversion, it’s crucial to understand the key differences between an LLLP and a private company (typically a corporation or a limited liability company, LLC):

- LLLP (Limited Liability Limited Partnership): In an LLLP, the general partners have limited liability similar to that of limited partners, meaning they are protected from personal liability for the business’s debts. However, this structure still operates as a partnership.

- Private Company (Corporation or LLC): A private company operates as a separate legal entity, independent from its owners (shareholders or members), and offers full liability protection. Additionally, a private company can raise capital, issue shares, and has a more formal management structure.

Step 2: Check Legal Requirements

The process of converting an LLLP to a private company is governed by the laws of the state or country where the LLLP was formed. Each jurisdiction has specific regulations regarding the conversion of business entities. It’s important to:

- Review State Laws: Some states allow for direct conversion from an LLLP to a corporation or LLC, while others may require a more complex procedure. Consult local business law or seek legal advice.

- Draft a Conversion Plan: A formal conversion plan outlines how the LLLP will transition to a private company, including the allocation of shares or membership units, changes in management, and how the assets and liabilities of the LLLP will be transferred.

Step 3: Obtain Partner Approval

To move forward with the conversion, the partners in the LLLP must agree to the change. This typically requires a vote or consensus based on the LLLP’s partnership agreement. Most partnership agreements include provisions outlining how significant changes to the structure of the business are to be approved.

Step 4: File Necessary Documents

Once the conversion plan is approved by the partners, the LLLP must file the necessary documents with the appropriate government agency, usually the Secretary of State’s office. The specific forms may vary but usually include:

- Articles of Conversion: This document officially acknowledges the transformation of the LLLP into a private company.

- Articles of Incorporation (for Corporation): If converting to a corporation, this document establishes the new company’s existence.

- Articles of Organization (for LLC): If converting to an LLC, this document will establish the new LLC entity.

Step 5: Update Business Licenses and Registrations

After the conversion is legally recognized, the business will need to update its various licenses, permits, and registrations. These may include:

- Business tax registration

- Local business licenses

- Employer Identification Number (EIN), if required for the new entity

- Any relevant industry-specific permits

Step 6: Transition Operational Structure

Converting from an LLLP to a private company will likely require changes in the business’s operational structure. Some key adjustments include:

- Management: A private company may have a more formalized management structure, such as a board of directors for corporations or managing members for an LLC.

- Ownership Structure: LLLPs have partners, while corporations have shareholders, and LLCs have members. You’ll need to define the new ownership roles and issue shares or membership interests accordingly.

- Tax Status: The tax treatment of a corporation or LLC is different from that of an LLLP. You may need to work with an accountant or tax advisor to understand how the business’s tax obligations will change and whether it qualifies for any tax elections (like S-Corp status for a corporation).

Step 7: Notify Stakeholders

It’s important to inform all relevant stakeholders—including employees, customers, suppliers, and investors—about the change in business structure. This will help ensure a smooth transition and maintain confidence in the business.

Benefits of Converting to a Private Company

There are several potential benefits to converting an LLLP into a private company:

- Increased Liability Protection: While LLLPs offer limited liability to general partners, corporations and LLCs provide full protection for all owners.

- Ability to Raise Capital: A private company, especially a corporation, can issue shares and raise capital from investors more easily than an LLLP.

- Simplified Ownership Structure: A corporation or LLC has a more straightforward and widely understood ownership and management structure, which can make it easier to attract investors and manage business growth.

To visit https://www.mca.gov.in

FAQs

For further details access our website https://vibrantfinserv.com