GST Registration Process: A Step-by-Step Guide

In today’s evolving business environment, Goods and Services Tax (GST) has become a crucial part of the financial landscape for businesses in many countries. GST registration is a fundamental step for businesses to comply with tax regulations and avail of various benefits. If you’re a business owner or planning to start one, understanding the GST registration process is essential.

What is GST Registration?

GST registration is a formal process where a business registers itself under the Goods and Services Tax regime. This registration allows businesses to collect tax on behalf of the government, claim tax credits for the taxes paid on inputs, and enhance their credibility with customers and suppliers.

Why is GST Registration Important?

- Legal Compliance: Ensures your business complies with the law.

- Tax Credit: Allows you to claim input tax credits on purchases.

- Business Credibility: Enhances your business’s reputation with clients and vendors.

- Market Access: Facilitates smooth transactions and eligibility to participate in government tenders.

Who Needs to Register?

Businesses need to register for GST if:

- Their turnover exceeds the threshold limit set by the government.

- They are involved in interstate trade.

- They deal in goods or services that are subject to tax.

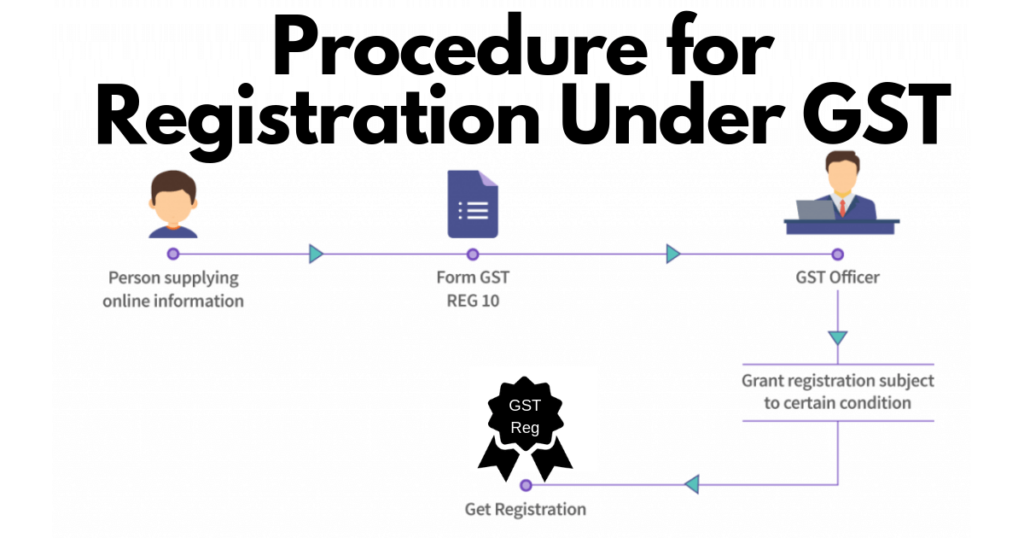

GST Registration Process: A Step-by-Step Guide

1. Determine Eligibility

- Assess if your business meets the criteria for mandatory registration based on turnover and nature of transactions.

2. Gather Required Documents

- Identity Proof: PAN card, Aadhaar card (for Indian businesses).

- Business Proof: Partnership deed, Certificate of Incorporation, or any legal document proving the business’s existence.

- Address Proof: Utility bills, rental agreements, or property documents.

- Bank Account Proof: Cancelled cheque or bank statement.

3. Choose the Right GST Portal

- Visit the official GST portal for your country (e.g., India’s GST Portal for Indian businesses).

4. Fill Out the Application Form

- Complete the GST registration form (GST REG-01 in India). Provide details about your business, including the type of business, PAN, and address.

5. Submit Documents

- Upload the required documents mentioned earlier. Ensure all documents are clear and up-to-date to avoid rejections.

6. Verification

- The GST authorities will examine your application and documents. They might ask for more details or further clarification if needed.

7. Receive GSTIN

- Upon successful verification, you will receive a unique GST Identification Number (GSTIN). This number must be displayed on all invoices and used in all GST-related transactions.

8. Compliance and Filing

- After registration, ensure timely compliance with GST regulations, including filing periodic returns and maintaining proper records.

Common Pitfalls to Avoid

- Incomplete Documentation: Ensure all required documents are submitted accurately.

- Incorrect Information: Double-check the details filled in the application form to avoid discrepancies.

- Missed Deadlines: Adhere to the deadlines for filing returns to avoid penalties.

Final Thoughts

GST registration might seem complex at first, but understanding each step can simplify the process significantly. Proper registration not only keeps your business compliant with tax laws but also provides a range of benefits including tax credits and enhanced credibility. Make sure to stay updated with any changes in the GST regulations and consult a tax professional if needed to ensure smooth registration and compliance.

Visit the official GST Portal at https://www.gst.gov.in/

FAQs

1.What is GST registration?

Ans: It’s the process of enrolling your business under the Goods and Services Tax system, allowing you to collect tax and claim credits.

2. Who needs to register for GST?

Ans: Businesses with turnover exceeding the threshold limit, those involved in interstate transactions, or those dealing in taxable goods or services.

3. What documents are needed for GST registration?

Ans: Identity proof, business proof, address proof, and bank account details.

4. How do I start the GST registration process?

Ans: Visit the official GST portal, fill out the registration form, and submit the required documents.

5. What is the GSTIN?

Ans: GST Identification Number (GSTIN) is a unique number assigned to businesses once they complete the registration process.

6. How long does GST registration take?

Ans: The process typically takes 7-15 days, depending on the completeness of your application and verification.

7. I apply for GST registration online?

Ans: Yes, GST registration can be completed online through the official GST portal.

8. What happens if my GST registration application is incomplete?

Ans: The GST authorities may reject the application or ask for additional information to complete the process.

9. Is GST registration mandatory for all businesses?

Ans: No, it’s only mandatory for businesses exceeding the turnover threshold or those engaged in interstate sales or taxable supplies.

10. What should I do after receiving my GSTIN?

Ans: Start issuing GST-compliant invoices, file regular GST returns, and maintain accurate records of all transactions.

For further details visit: https://vibrantfinserv.com/

Contact: 8130555124, 8130045124

Whatsapp: https://wa.me/918130555124

Mail ID: operations@vibrantfinserv.com

Web Link: https://vibrantfinserv.com

FB Link: https://fb.me/vibrantfinserv

Insta Link: https://www.instagram.com/vibrantfinserv2/

Twitter: https://twitter.com/VibrantFinserv

Linkedin: https://www.linkedin.com/in/vibrant-finserv-62566a259/