![]()

GST for for Tour and Travel

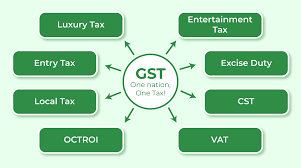

GST for for Tour and Travel, GST (Goods and Services Tax) is a comprehensive form of indirect taxation imposed on the provision of goods and services at every stage of their production or distribution.

It has replaced multiple cascading taxes like VAT, service tax, and excise duty, streamlining the taxation process.

Here’s how GST impacts tour and travel agencies during a tax audit:

1. Input Tax Credit (ITC):

Tour agencies can claim Input Tax Credit on GST paid for various inputs like hotel stays, transportation services, and other expenses related to their business operations.

During a tax audit, the agency must ensure that the ITC claimed is supported by proper documentation and aligns with the nature of their services.

2. Interstate Transactions:

If a tour agency operates in multiple states, it needs to understand the implications of Integrated GST (IGST) on its interstate transactions.

Proper documentation and accurate reporting of interstate supplies are vital to avoid discrepancies during a tax audit.

3. Tour Packages Classification:

Tour and travel agencies often offer bundled services, including accommodation, transportation, and meals.

Classifying these services correctly under different GST rates (e.g., transportation, hotel accommodation, or composite supply) is crucial to avoid misinterpretations during an audit.

4. Reverse Charge Mechanism:

Under the reverse charge mechanism, the liability to pay GST shifts from the supplier to the recipient.

Tour agencies need to be aware of instances where they are liable to pay GST under this mechanism, especially for services from unregistered vendors.

Proper compliance is essential to avoid audit issues.

5. Place of Supply Rules:

Correctly determining the place of supply is crucial for determining the applicable GST rate (CGST + SGST/UTGST or IGST).

During a tax audit, agencies should ensure that they have accurately applied the place of supply rules based on the nature of the services provided. Concept of GST

6. Valuation of Services:

GST is applied on the transaction value of services. Tour agencies need to ensure that their valuation methods are consistent and adhere to GST rules. Incorrect valuation can lead to audit queries.

7. E-commerce Operator Obligations:

If the agency operates as an e-commerce platform for accommodation or travel services, it has specific GST compliance responsibilities.

Ensuring proper collection and remittance of GST on behalf of suppliers is essential during an audit.

8. Record Keeping:

Comprehensive and organized record-keeping of invoices, receipts, and other financial documents is critical.

During a tax audit, agencies must present clear and verifiable records to substantiate their GST calculations and compliance.

Understanding these GST implications and adhering to proper compliance procedures can help tour and travel agencies navigate tax audits smoothly and avoid potential penalties or disputes Concept of GST

To visit: https://www.incometax.gov.in

For further details access our website: https://vibrantfinserv.com