GST Compliant Invoice

GST Compliant Invoice

What is a GST-Compliant Invoice?

Introduction

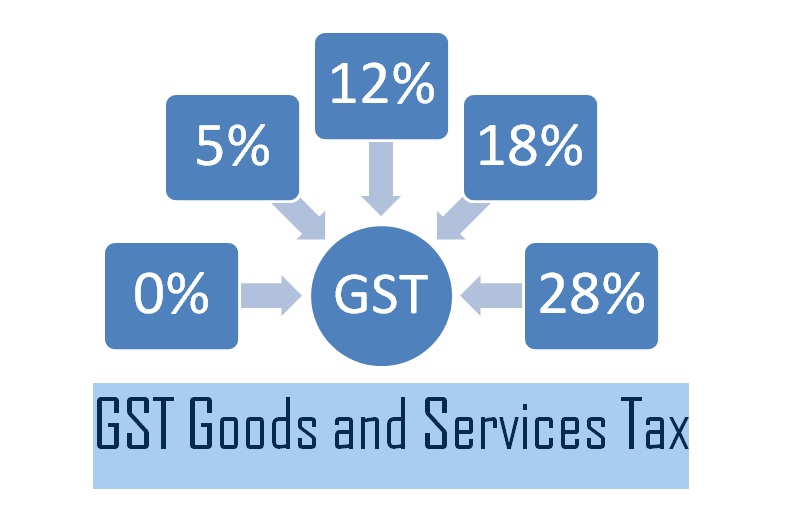

The Goods and Services Tax (GST) has transformed the taxation system in numerous countries, including India. It simplifies tax structures by integrating various indirect taxes into a single system. A critical component of GST is a GST-compliant invoice, which serves as a legal document for transactions under the GST regime. Ensuring compliance with GST invoicing rules is crucial for businesses to claim input tax credits (ITC) and avoid penalties.

Definition

A GST-compliant invoice is an invoice issued by a registered taxpayer that adheres to the regulations prescribed under the GST law. It contains essential details such as the supplier’s and buyer’s GST Identification Number (GSTIN), invoice number, date, description of goods or services, tax breakup, and other statutory details. This invoice acts as a valid document for tax payments and ITC claims.

Application of a GST-Compliant Invoice

A GST-compliant invoice is required for various business transactions, including:

- Sale of Goods or Services – Any supply of taxable goods or services must be accompanied by a GST-compliant invoice.

- Claiming Input Tax Credit (ITC) – Businesses can claim ITC only if they have a proper GST invoice from their suppliers.

- Export Transactions – For exports, invoices must be compliant with GST rules and may include additional declarations.

- Inter-State and Intra-State Sales – The invoice ensures proper tax collection and distribution between state and central governments.

Benefits of a GST-Compliant Invoice

- Ensures Legal Compliance – Adhering to GST invoice regulations helps businesses avoid penalties and legal issues.

- Facilitates Input Tax Credit (ITC) – A proper GST invoice allows businesses to claim tax credits, reducing overall tax liability.

- Enhances Transparency – A standardized invoicing system helps maintain clarity in business transactions.

- Improves Business Credibility – Following GST norms enhances the credibility of businesses in the market.

- Eases Tax Return Filing – Proper invoicing simplifies the process of filing GST returns and audits.

Limitations of a GST-Compliant Invoice

- Complexity for Small Businesses – Understanding and adhering to all invoice requirements can be challenging for small businesses.

- Administrative Burden – Preparing detailed invoices requires extra effort, especially for high-volume transactions.

- Technical Challenges – Digital invoicing may require businesses to invest in accounting software or ERP systems.

- Risk of Errors and Penalties – Incorrect invoicing can lead to penalties and issues in tax return processing.

Comparative Table: GST vs. Non-GST Invoice

| Feature | GST-Compliant Invoice | Non-GST Invoice |

|---|---|---|

| GSTIN Mentioned | Yes | No |

| Tax Breakup (CGST, SGST, IGST) | Yes | No |

| Input Tax Credit Eligibility | Yes | No |

| Legal Requirement for GST Registered Businesses | Mandatory | Not Required |

| Easier Tax Filing | Yes | No |

Conclusion

A GST-compliant invoice is a crucial document that ensures tax compliance, facilitates input tax credit claims, and enhances transparency in business transactions. While it offers several benefits, businesses must be vigilant in maintaining accurate invoicing practices to avoid penalties and administrative challenges. With the increasing adoption of digital invoicing, businesses can leverage automated solutions to streamline their GST-compliant invoicing process, ensuring smooth tax compliance and operational efficiency.

To visit https://www.gst.gov.in/

FAQs

1. What is a GST-compliant invoice?

Ans: A GST-compliant invoice is a document that meets the requirements set by the Goods and Services Tax (GST) laws, including specific details about the transaction and taxes applied.

2. What are the essential elements of a GST-compliant invoice?

Ans: Key elements include the seller’s and buyer’s details, GSTINs, invoice number, date, description of goods/services, quantity, value, GST rates, and the amount of GST charged.

3. Do I need to include GSTIN on the invoice?

Ans: Yes, both the seller’s and buyer’s GST Identification Numbers (GSTINs) must be include on the invoice.

4.What should be the format of the GST-compliant invoice?

Ans: The invoice should be in a structured format with clearly listed details, including taxes and amounts. It can be in digital or physical format, as long as it meets GST requirements.

5. Is it mandatory to mention HSN/SAC codes on the invoice?

Ans: Yes, the Harmonized System of Nomenclature (HSN) code for goods or the Service Accounting Code (SAC) for services must be mentioned to classify the items accurately.

6. How should GST rates be display on the invoice?

Ans: GST rates must be shown separately for each type of supply, including CGST (Central GST), SGST (State GST), or IGST (Integrated GST) as applicable.

7. Can an invoice be issue without GST details?

Ans: No, an invoice must include GST details to be consider valid under GST laws. Failure to do so can lead to non-compliance issues.

8. Is it necessary to issue a GST-compliant invoice for export transactions?

Ans: Yes, even for export transactions, a GST-compliant invoice must be issue, and it should specify that the supply is zero-rate.

9. What are the consequences of issuing a non-compliant invoice?

Ans: Issuing a non-compliant invoice can result in penalties, disallowed input tax credits, and other legal issues.

10. Can I use software to generate GST-compliant invoices?

Ans: Yes, using accounting or invoicing software that supports GST compliance can help ensure that invoices meet all the necessary requirements and reduce errors.