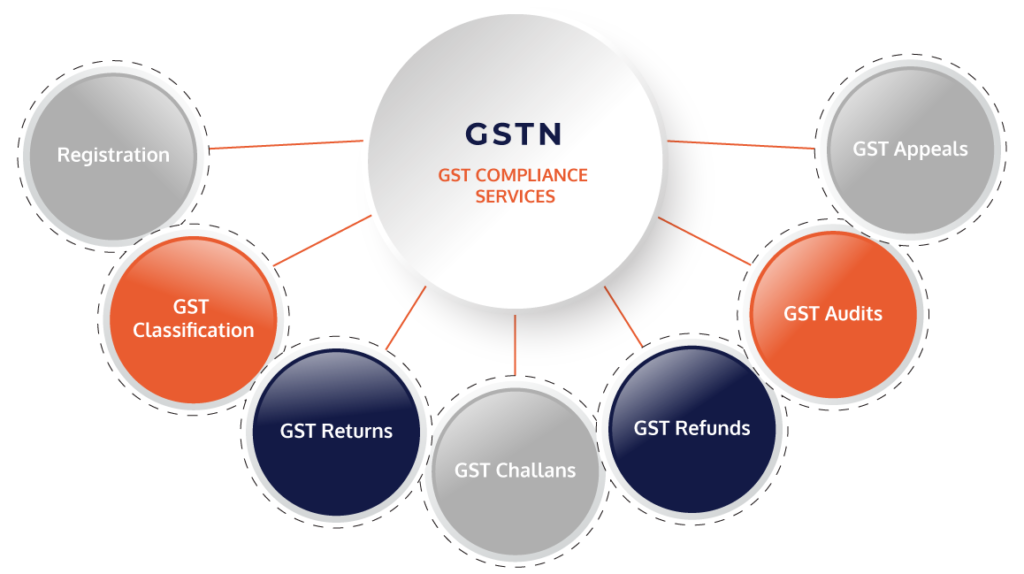

GST Compliance, In India, when we talk about GST compliance, it means abiding by the guidelines and regulations established by the Goods and Services Tax (GST) system, which has been implemented by the Government of India:

Good and service Tax Registration:

Businesses that meet the prescribed turnover threshold are required to register for GST. They must apply for GST registration and obtain a unique Goods and Services Tax Identification Number (GSTIN) from the tax authorities.

GST Returns:

Registered businesses are require to file regular GST returns to report their sales, purchases, and tax liability. The frequency of filing depends on the turnover of the business, with monthly, quarterly, and annual filing options available.

Invoicing and Documentation:

Businesses must issue GST-compliant invoices for their taxable supplies, following the prescribed format and including necessary details such as GSTIN, HSN/SAC codes, and tax amounts. They should maintain proper books of accounts and retain relevant records for the specified period.

Tax Payment:

Businesses must pay the GST liability on time and through the designated payment modes. Payments can be made online through the GST portal or authorized banks.

Input Tax Credit (ITC):

Registered businesses can claim input tax credit on their purchases and use it to offset their tax liability. However, they must comply with the conditions for availing ITC and maintain proper documentation to support their claims.

Compliance with Anti-Profiteering Measures:

Businesses must comply with anti-profiteering provisions, ensuring that any reduction in tax rates or availability of input tax credit is pass on to the customers by adjusting the prices of goods or services.

Record Keeping:

Maintaining accurate and up-to-date records is essential for GST compliance. Businesses should maintain records of sales, purchases, expenses, tax payments, and other relevant documents as per the specified requirements.

GST Audits and Assessments:

Tax authorities have the power to conduct GST audits or assessments to verify the accuracy and compliance of a business’s GST-related activities. Businesses must cooperate with the authorities during such audits and provide necessary information and documents.

It’s important for businesses to stay updated with the latest GST laws, notifications, and compliance requirements issue by the government. Non-compliance with GST regulations can result in penalties, fines, and other legal consequences. Seeking guidance from tax professionals or consulting official resources, such as the GST portal and publications by the tax authorities, can help businesses ensure proper GST compliance in India.

To visit https://www.gst.gov.in/

For further details access our website https://vibrantfinserv.com